All reversals begin with a Trend Line Break (on how to draw trend lines see this post) or a Trend Channel Line Overshoot (too far too fast) before the actual Reversal happens.

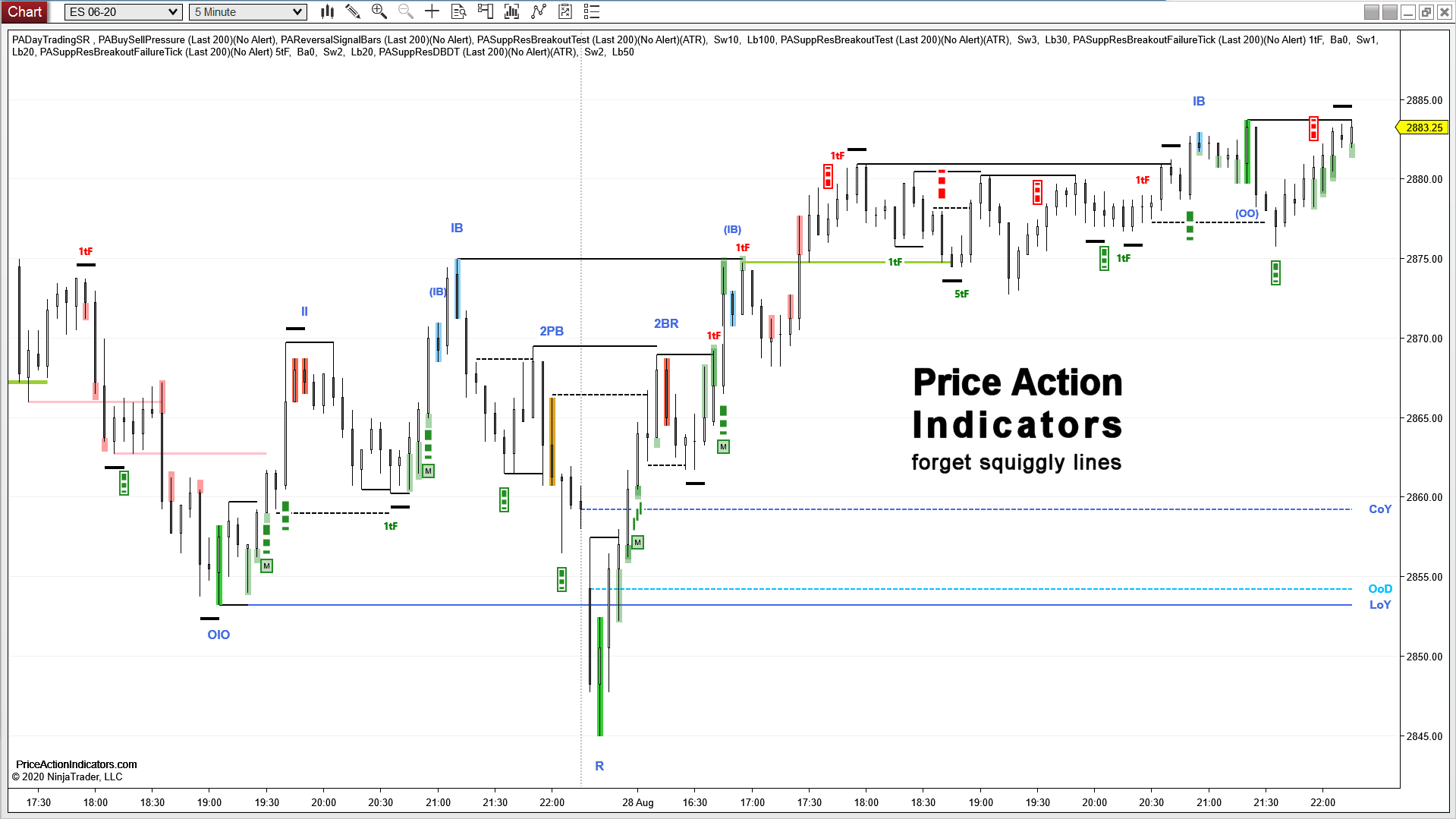

These charts use the Reversal Signal Bars indicator for NinjaTrader® 7/8.

Only trends can reverse, trading ranges have failed breakouts.

By implication, you need a strong trend bar before a reversal signal to make it strong. A doji before a reversal signal makes it weak (because a doji is a trading range and its breakout will probably fail, giving a little reversal bar and its breakout on the other side probably will also fail).

Types of Reversals

- Examples for Higher Low Major Trend Reversal

- Examples for Lower Low Major Trend Reversal

- Examples for Higher High Major Trend Reversal

- Examples for Lower High Major Trend Reversal

Location

- Trend Line, Trend Channel Line (overshoot)

- Previous Highs or Lows

- High of Yesterday or Low of Yesterday

Pattern

- after a two-legged move

- after three pushes, creating a Wedge pattern

- Double Top or Bottom

- not in tight TR, Barb Wire, overlap or against logical support or resistance

Strengtheners

- third push

- trend line break

- obnoxious/second Trend Channel Line Overshoot

- is the setup mid range or better at the extremes

Weakeners

- not enough bars on the “other” side of the trend line (might be a sign for weakness of the counter trend traders)

- if trend move is too strong (e.g. 4 or more bars down for a bull reversal) wait for 2nd entry

- the reversal signal bar occurs in a tight trading range, Barb Wire or is heavily overlapped

- if risk is too large wait for a 1st pullback (1P) after a trend attempt off of the reversal

- wait for trapped traders from the old trend

- the Reversal Signal Bar is too small – counter trend traders look weak

- the Reversal Signal Bar is too large – it can become a trading range (more sellers above then buyers and vice versa)

Confluence

Have at least two reasons to take a trade. Read more here:

Look for confluence, when trading a reversal

Reversal Signal Bars and Patterns

A Reversal Signal can be a single candlestick or a pattern that signals a trader that a possible reversal is likely setting up. Sometimes a Signal Bar can be a setup for a trade in either direction.

Read more here: Signal Bars & Patterns

How to enter on a Reversal Signal

There are several ways how to enter a trade on a reversal signal. All have advantages and disadvantages and finally depend on the market context and the trader.

Read more here: Reversal Signal Entry Strategies

How to Trade – Reversal Signals

Once a Reversal Signal shows up on the chart place a stop entry buy order one tick above the bar or pattern (for bull). The closest logical stop goes below the bar or pattern – a bar/pattern stop.

Read more here: How to Trade a Reversal Signal

Please read also:

Please tell us what you think is missing, any kind of feedback is highly appreciated – contact us