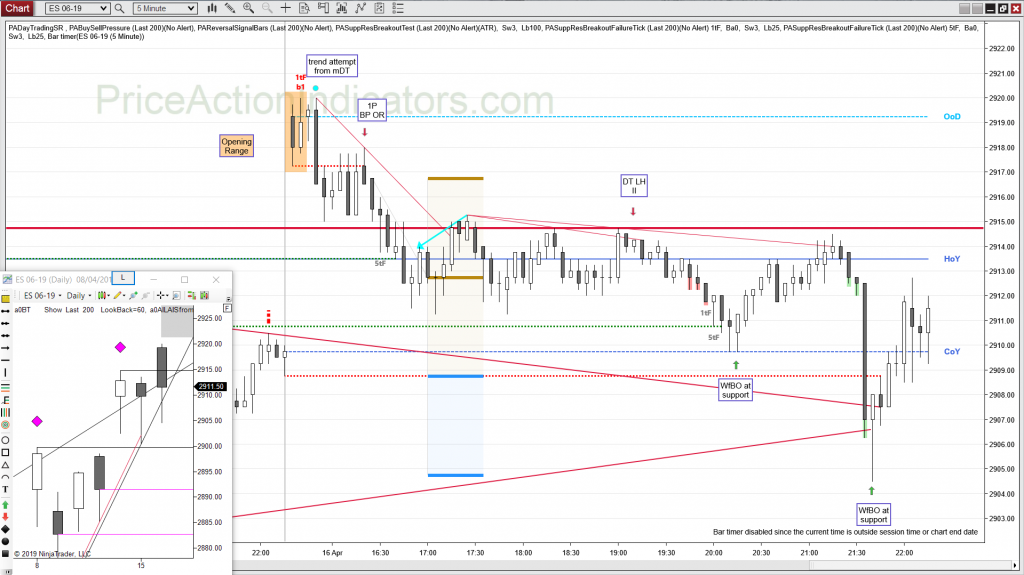

Bull gap, above HOY, Opening Range, 1P, DT, WfBO

LOD was at the shallowest trend lines from yesterday

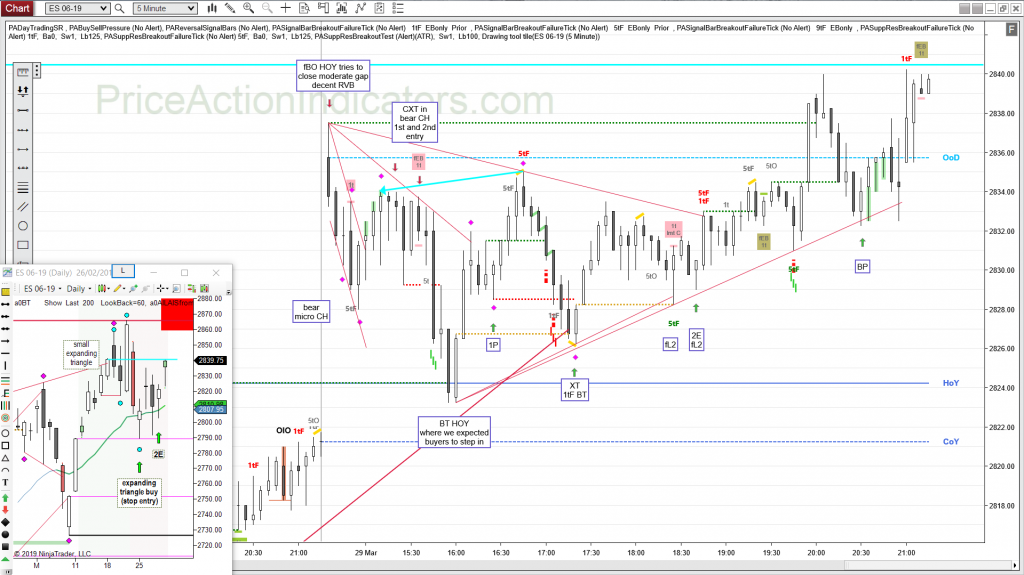

daily chart

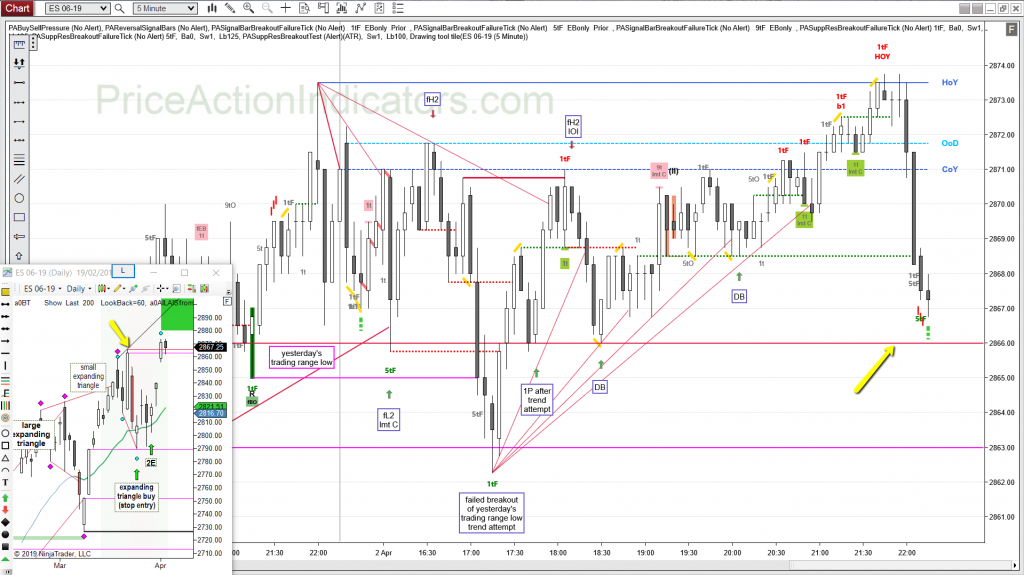

Always In Long (AIL) since 03/29

3rd trend channel line (TCL) overshoot and another close back below the TCL

bears need a close below Monday low to switch to Always In Short (AIS)

bulls bought with lmt orders at the steep bull trend line, probably more up