Reversal Signal Entry Strategies

There are several ways to enter a trade on a reversal signal. All have advantages and disadvantages and finally depend on the market context and the trader. This post only represents a small selection of possible entry methods and doesn’t cover scale-in type of trade entries or trading a penetration of a micro trend line.

To find reversal signals, you can use the Reversal Signal Bars indicator.

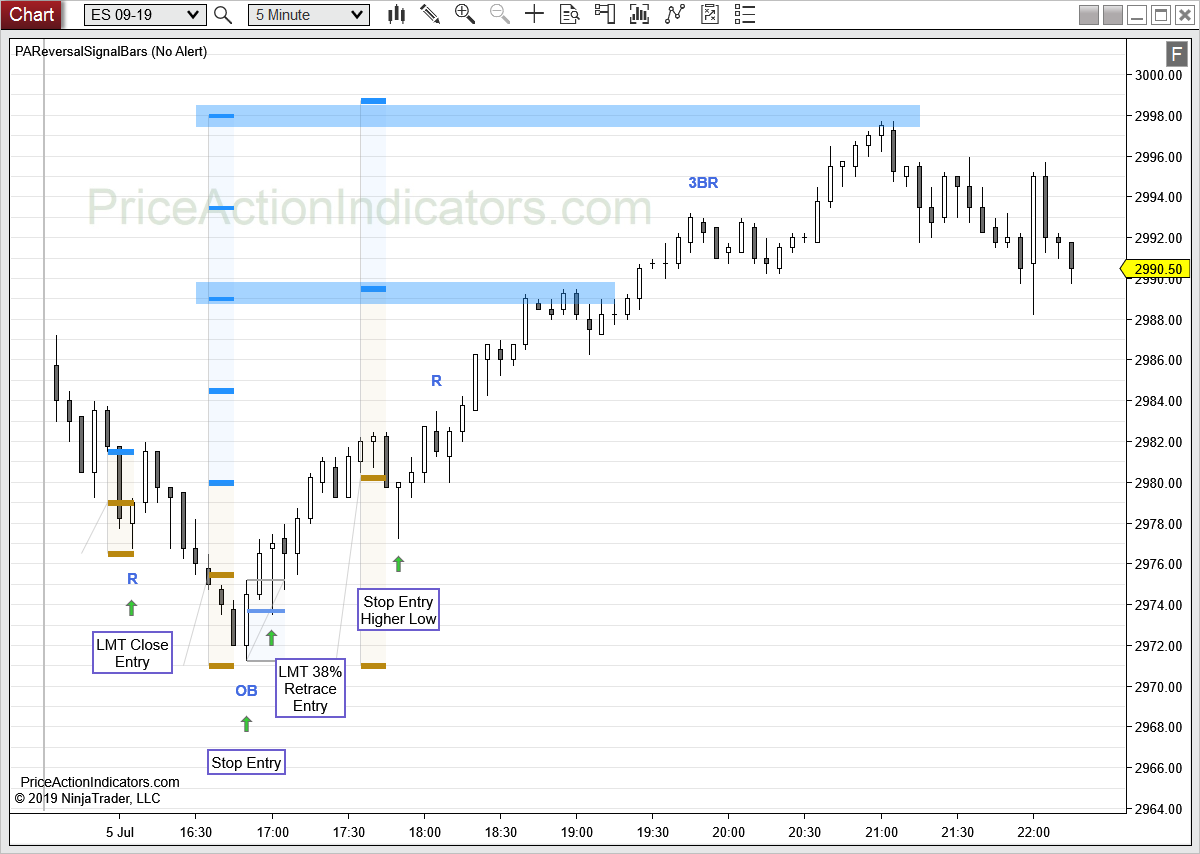

Stop Entry (Break of High or Low of the Signal Bar or Pattern)

This is the classic entry type for a reversal signal bar or pattern.

Place a buy or sell stop entry order one tick above/below the signal bar or pattern. This will be executed, once price breaks above/below the signal bar or pattern.

LMT Close Entry (early/aggressive)

Place a buy or sell limit order at the close of the reversal signal bar or pattern. This type of entry should only be used if there is a strengthener for the Reversal Signal (e.g. Tick Failure Breakout, Double Bottom/Top or other reason). On urgency it’s necessary to buy/sell a few ticks worse (chase).

LMT Retracement Entry

Wait for the market to trigger the reversal signal (break above/below the signal bar or pattern) and retrace some extent before entering a trade. You can use Fibonacci numbers or 1/3rd, 1/2 or 2/3rds the range of the signal bar or pattern.

Keep in mind, that using a retracement entry to get a better Reward/Risk ratio, might make you miss out on a trade.

Stop Entry Higher Low or Lower High

Wait for the market to trigger the reversal signal (break above/below the signal bar or pattern) and judge the move off of the reversal signal.

Was there a strong Entry Bar – a shaved or small tailed trend bar?

Was the Entry Bar low not taken out by more than two ticks (for the ES E-mini)?

Is there a one legged move, that takes out a prior lower high or higher low?

If so, consider to buy/sell a signal bar at a higher low or lower high (a pullback) and keep your stop loss beyond the reversal signal bar or pattern.

A pullback gives you a measure of the market’s strength – what bulls and bears “have” and everyone in the market gets that same information, which is why I prefer to enter on pullbacks. When everyone in the market reads the exact same thing, price will take off. This is why 1st pullback setups are extremely suitable for swing trading.

Keep in mind, that using a pullback entry to get a higher probability, might make you miss out on a trade.

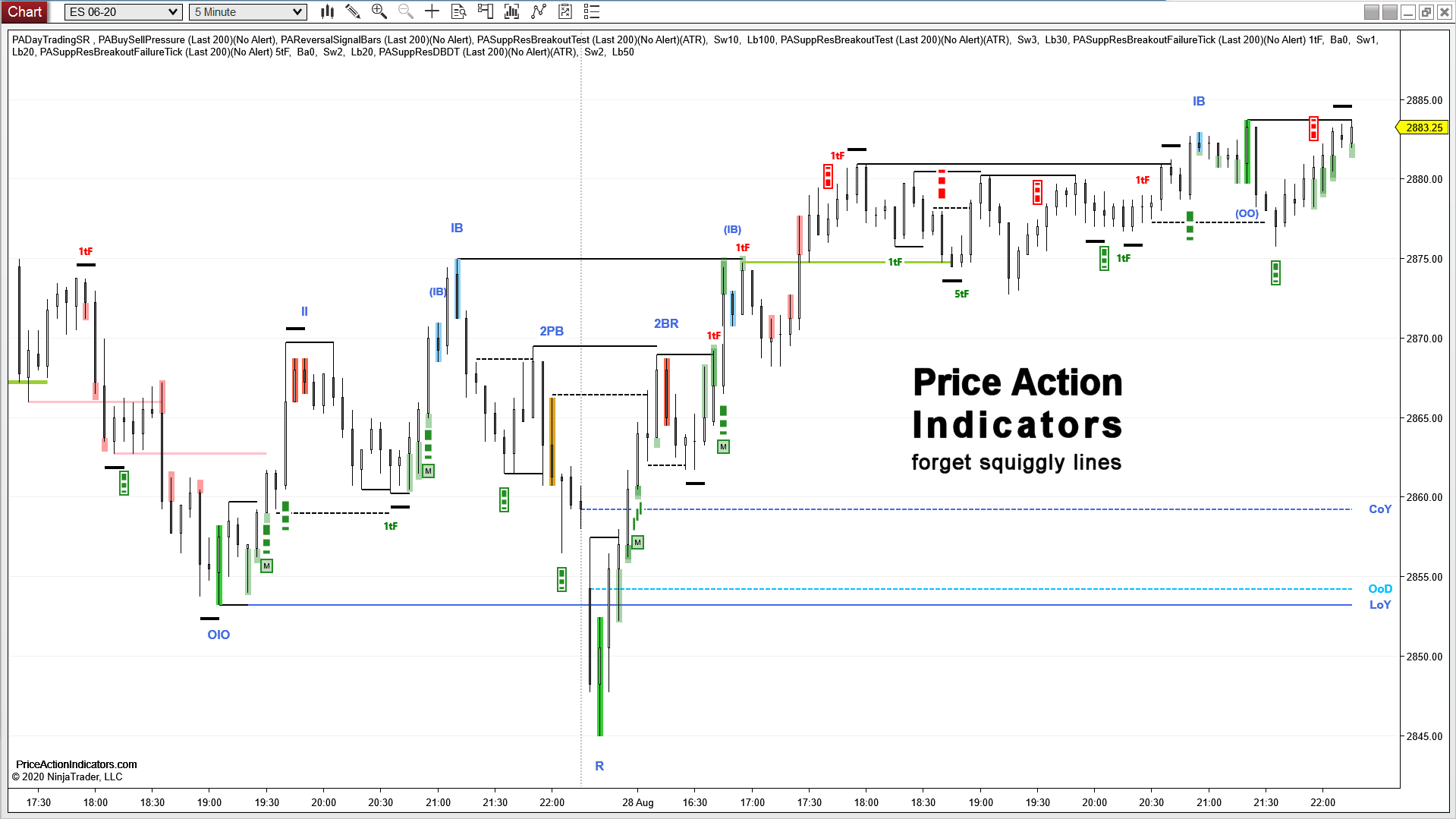

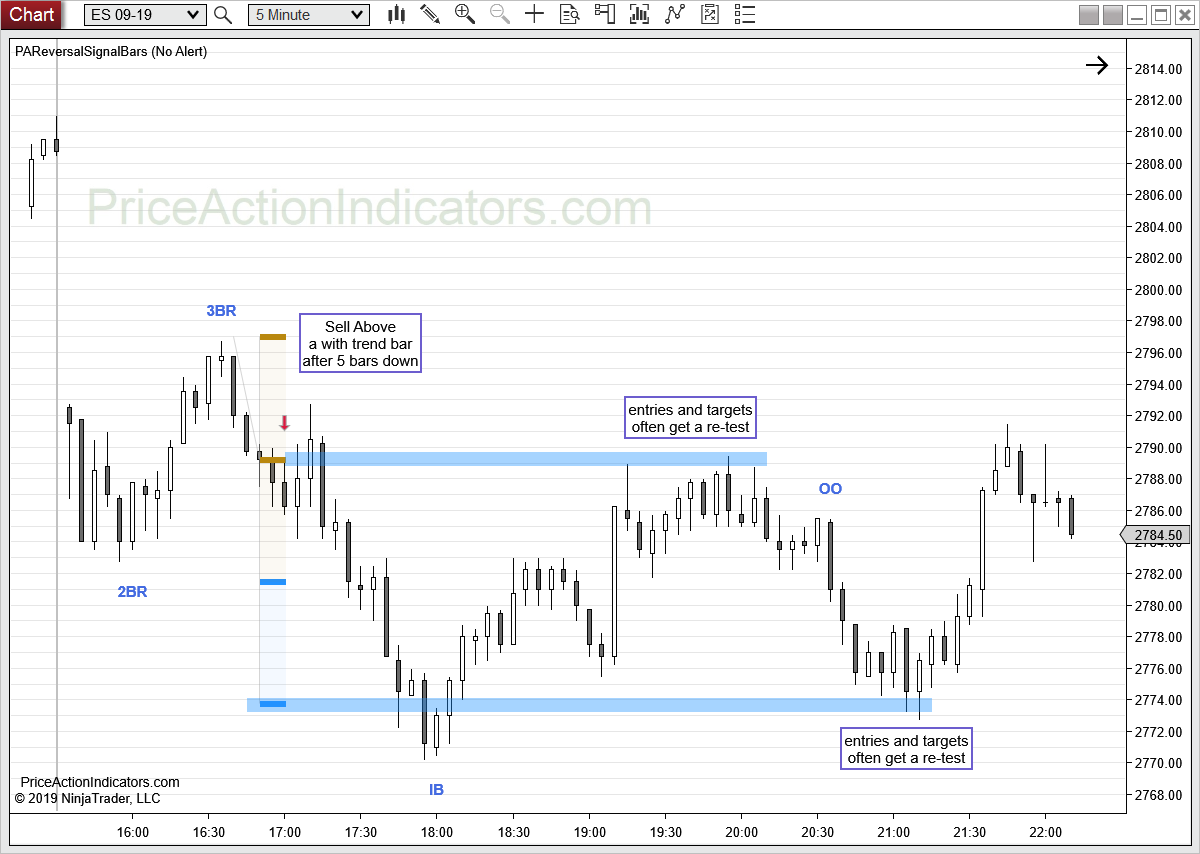

the chart shows possible targets based on the initial risk of the trades

Please read also:

Late Entries on Urgency (aggressive)

LMT Close or Breakout of Entry Bar

Wait for the market to trigger the reversal signal (break above/below the signal bar or pattern) and buy sell the close of the Entry Bar, if that is a shaved or small tailed trend bar and the market shows signs of urgency.

One can also place a buy or sell stop entry order one tick above/below the Entry Bar for the breakout entry type.

LMT Buy Below or Sell Above a with trend bar

On a spike off of the reversal bar/pattern, advanced traders can buy below (BB) the prior bar (in a bull) or sell above (SA) the prior bar (in a bear) with a limit order, if that is a with trend bar.

The limit order for a sell needs to go AT THE HIGH of the prior bar.

This often requires using a wider stop.

LMT Buy the Low or Sell the High of the prior bar

Even more aggressive is to buy the low of the prior bar in a bull or sell the high of the prior bar in a bear, anticipating a micro double bottom or top.

The limit order for a buy needs to go at least one tick ABOVE THE LOW of the prior bar to get filled and not at the low of the prior bar. On urgency this can become a couple of ticks.

This strategy often requires using a wider stop.

Other considerations

Before entering a trade always determine, if your planned Reward/Risk fits into market structure. Also judge the probability for the market to hit your target before the Close, if you need to close your trade at the end of the day.

Signal Bars & Patterns

Entry strategies

How to Trade

Automated Trading

More Charts

Please tell us what you think is missing, any kind of feedback is highly appreciated – contact us