Support and Resistance – Double Bottom / Double Top

Indicator for NinjaTrader® 8 ONLY!

Features

- Shows Support (Double Bottom) or Resistance (Double Top), that is tested by subsequent price action

- Shows micro Double Bottoms & micro Double Tops

- Shows Double Bottom & Double Top with the 1st bar of the session (for RTH traders)

- NEW compares the volume of the current bar with the volume of the 1st Bottom/Top (“old” support or resistance)

- use as a discretionary indicator and for Automated Trading with BloodHound

- shows signals in real-time

- alert feature

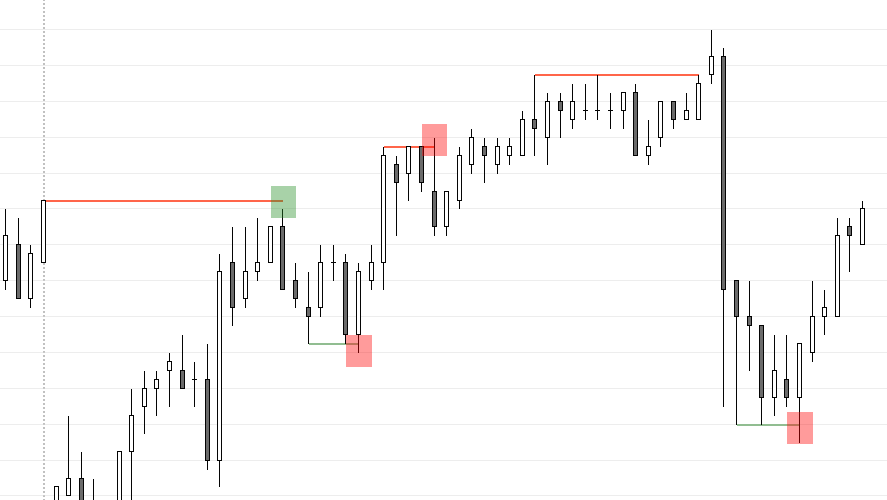

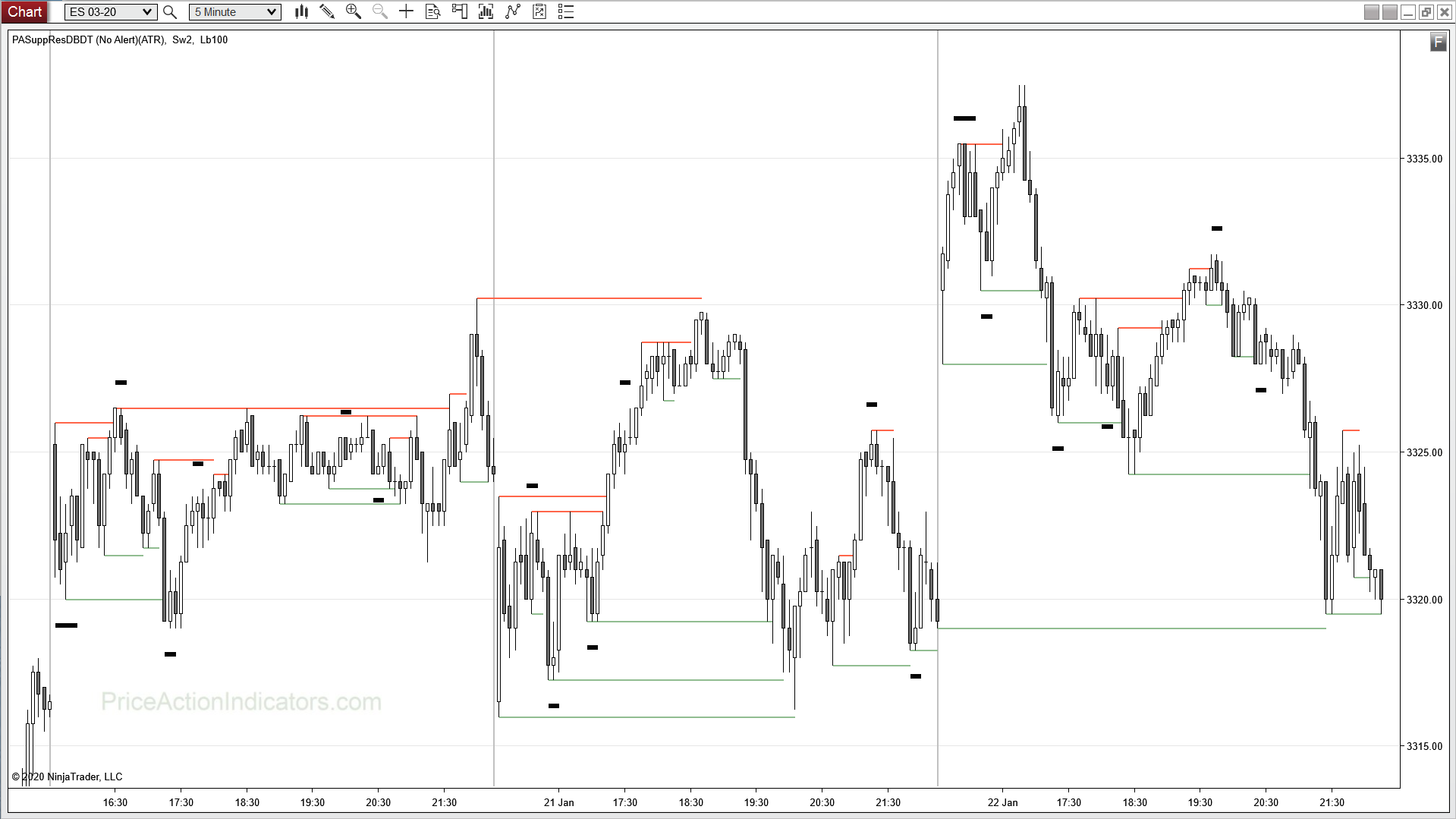

Example Charts

Download a 20 day trial version

Buy now for US $ 180

you get redirected to our reseller MyCommerce/Digital River/Share-it to place your order

to order you need your NinjaTrader® Machine ID (please see FAQ)

for license activation (please see FAQ)

Please contact us for a discount if you’re going to buy more than one indicator.

“Hi Thomas, thank you for the work you have developed.

I have downloaded all of your indicators, trial and free

and started to get a feel for them one by one.” Great stuff!

Paul C.

What is Support and Resistance?

Support and resistance are important levels where lots of buyers and sellers are willing to trade a security. It is probably the most popular price action concept used by price action traders. If these levels are broken, market psychology can shift and new levels of support and resistance might get established. Although single lines look nice on a chart, levels need to be seen as zones.

Like Al Brooks is saying here “One of the most useful rules in trading is that if something resembles a reliable pattern, it will likely behave like the reliable pattern. In any case, nothing is ever perfect or certain, so close is usually close enough.”

A support level is a level price tends to bounce off, find support as it falls. A resistance level is a level price tends to find resistance as it rises. If price breaks through a support and resistance level it is likely to continue until approaching another support or resistance level.

Every swing point can be considered a potential support or resistance level, although major swing highs and lows hold more significance, as they are visible to higher time frame traders too. Trend lines, trend channel lines and moving averages can be support and resistance too (usually very subjective, because of all the variants one can draw them).

Can I simply trade every signal?

- this largely depends on context, trading style and stop loss (risk), also on your ability to scale in and the use of wide or swing stops (below the last higher low or above the last lower high in a trend)

- in a pullback in a trend it’s also reasonable to buy/sell closes (exhaustion) near support or resistance levels to enter with trend

- look for confluence to increase the probability of a successful trade by waiting e.g. for a strong Reversal Signal Bar after a couple of pushes at a support or resistance level and trade that with a stop entry

Examples from the Blog

Be sure to check out the Blog for more examples.

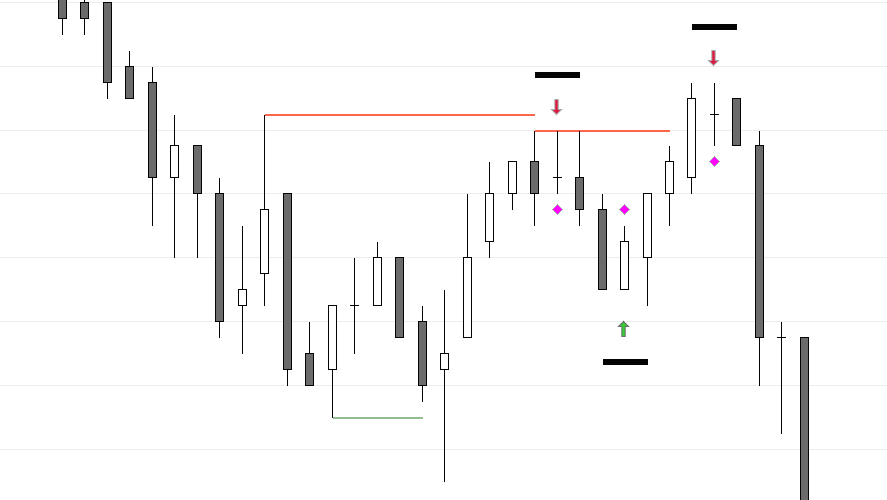

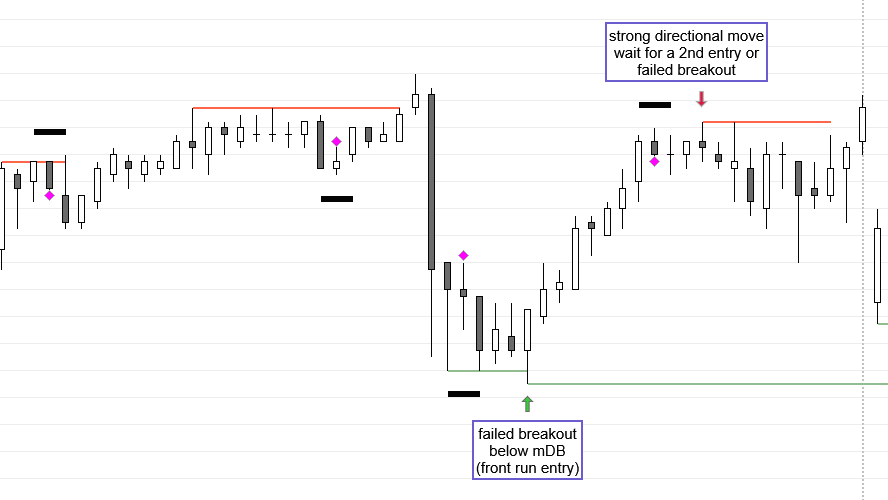

Micro double bottom (mDB) and micro double top (mDT)

A micro double bottom (mDB) or micro double top (mDT) consist of consecutive or almost consecutive bars with matching or nearly identical lows or highs. Micro double bottoms/tops are often traditional double bottoms/tops on a smaller time frame. The traditional DB/DT from the 4000 tick chart (left) are mDB/mDT on the 5 min chart (right).

Two lows (for a micro double bottom) occurring at the same level is only the first sign of a possible micro double bottom. Price needs to rise from the 2nd bottom above the extreme between the two bottoms – the neckline (marked with the magenta colored diamonds on the chart above). Vice versa for a micro double top.

The conservative entry for a mDB or mDT is a stop entry 1t beyond the neck line (marked here with magenta colored diamonds).

If you get a good Signal Bar at the 2nd bottom or top it makes sense to front run the conservative entry.

On a signal against a strong directional move it makes sense to wait for a 2nd attempt, a 2nd entry or strengtheners – e.g. a failed breakout.

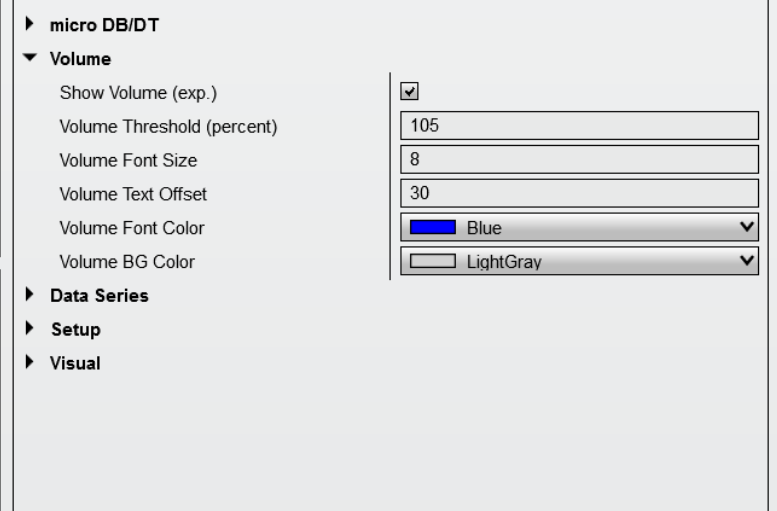

Volume

Decreasing or less volume, when approaching an old support or resistance shows a lack of interest from professional money to participate at these areas and prices are more likely to reverse.

The latest version of the Double Bottom/Top indicator compares the volume of the current bar with the volume of the 1st Bottom/Top (“old” support or resistance).

This calculated percentage (current bar’s volume divided by 1st Bottom/Top volume) can now be printed on the current bar. A value below 100 means, that the current volume is less than the volume transacted earlier at that support or resistance level, which might be an indication for that to reject price.

The “Volume Threshold” setting filters volumes below a certain percentage.

At the moment this is an experimental feature and in a constant development process.

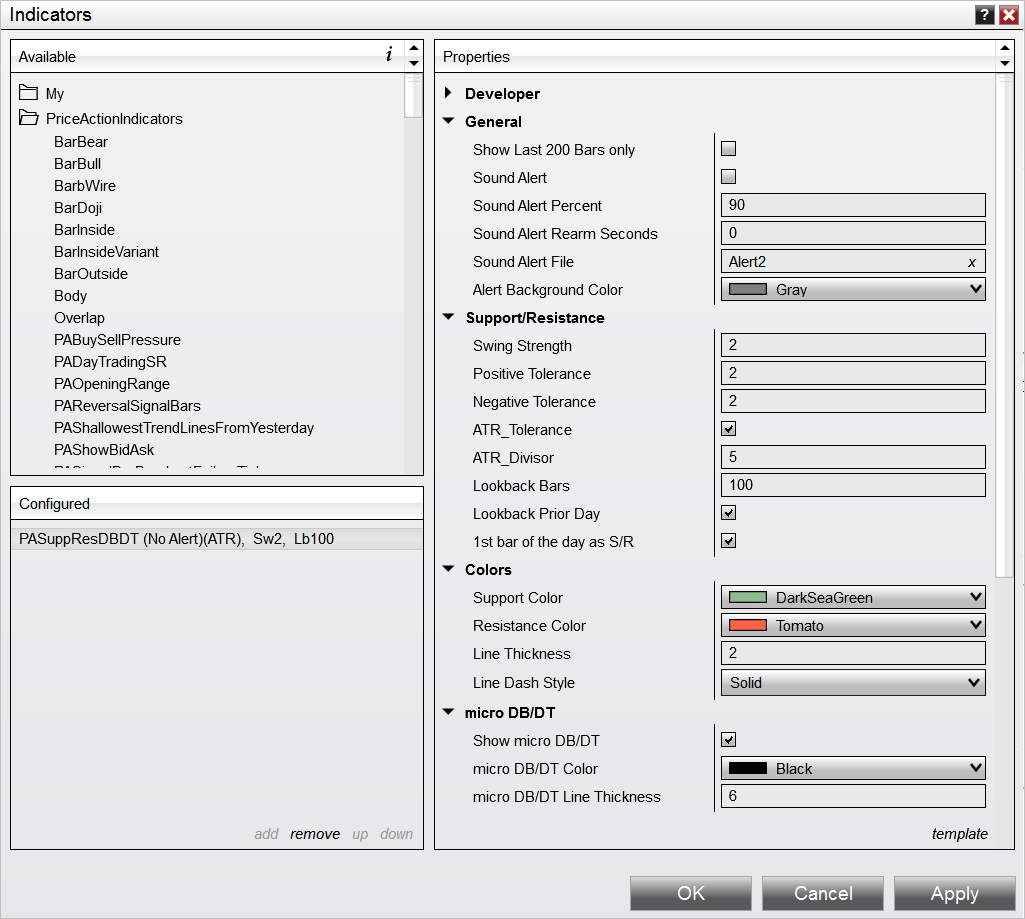

What are the settings?

Indicator name: PASuppResDBDT

Show Last 200 Bars only

Show the indicator signals only for the last 200 bars, which will speed up a reload of the chart or indicator

Sound Alert

Play a sound and show an alert in the alert window

Sound Alert Percent

Sound Alert, when Bar is to (Percent) complete (does not work for Range, Kagi or LineBreak)

leave Rearm Seconds 0 (zero), if using on a Range, Kagi or LineBreak chart

Sound Alert Rearm Seconds

Rearm Sound Alert after (Rearm Seconds)

if not using Sound Alert Percent or for Range, Kagi or LineBreak

Sound Alert File

Pick a .WAV file from the NinjaTrader sound folder (how to install sounds, see here )

Swing Strength

Show Support/Resistance lines only for swings with a certain swing strength

e.g. 1 = one bar with a lower high to the left and right of a swing high

use one or more instances of the indicator to show support/resistance levels of a certain strength for a different number of bars back only

Positive Tolerance and Negative Tolerance

Positive and Negative Tolerance is set in ticks.

A gap between the Support or Resistance level and price (undershoot) is considered a Positive Tolerance, an overshoot is considered Negative Tolerance.

in “ATR_Tolerance” mode these are a multipliers, please see below

ATR Tolerance

Use “ATR_Tolerance” mode for Positive/Negative Tolerance instead of ticks.

With this mode, the ATR(10) is divided by the ATR_Divisor and then multiplied by the values set for Positive and Negative Tolerance .

Example: ATR_Divisor = 10

Positive Tolerance = 1

Negative Tolerance = 2

ATR(10) = 3 points (calculated from the last 10 bars)

Positive Tolerance = 1/10 * 3 points = 0.3 points

Negative Tolerance = 2/10 * 3 points = 0.6 points

ATR Divisor

The ATR(10) is divided by the ATR_Divisor (higher values give smaller tolerance) and then multiplied by the values set for Positive and Negative Tolerance.

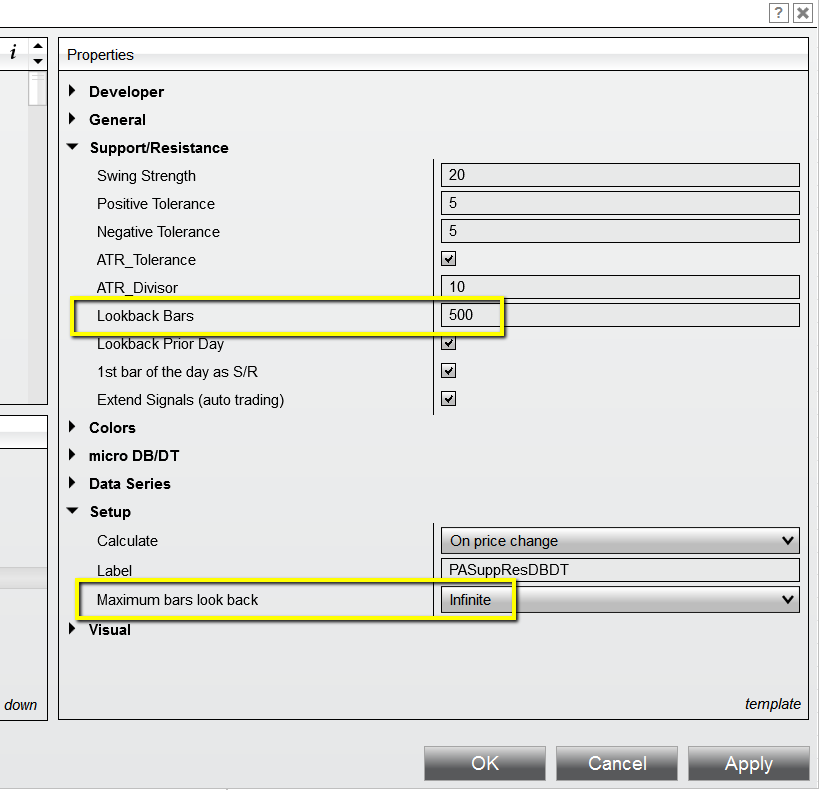

Lookback Bars

Number of bars back to look for support or resistance

If you want to use a Lookback larger than 256, set “Maximum bars look back” to “Infinite” in the Setup of the indicator.

Look back Prior Day

Show support or resistance from the prior session

1st bar of the day as S/R

Use the high/low of the 1st bar of the day as support or resistance, regardless of swing strength set above. This can be useful, if you trade RTH charts.

Extend Signals (auto trading – NT8 only)

Use this setting, if using the indicator for automated trading (Bloodhound or your own indicators/strategies).

If switched on, the signal for the Double Bottom/Top (in the data series) is extended to the next two bars after the pivot, depending on price.

Line Thickness

E.g. use thicker lines for higher strength support and resistance

Line Dash Style

E.g. use different dash styles for higher strength support and resistance

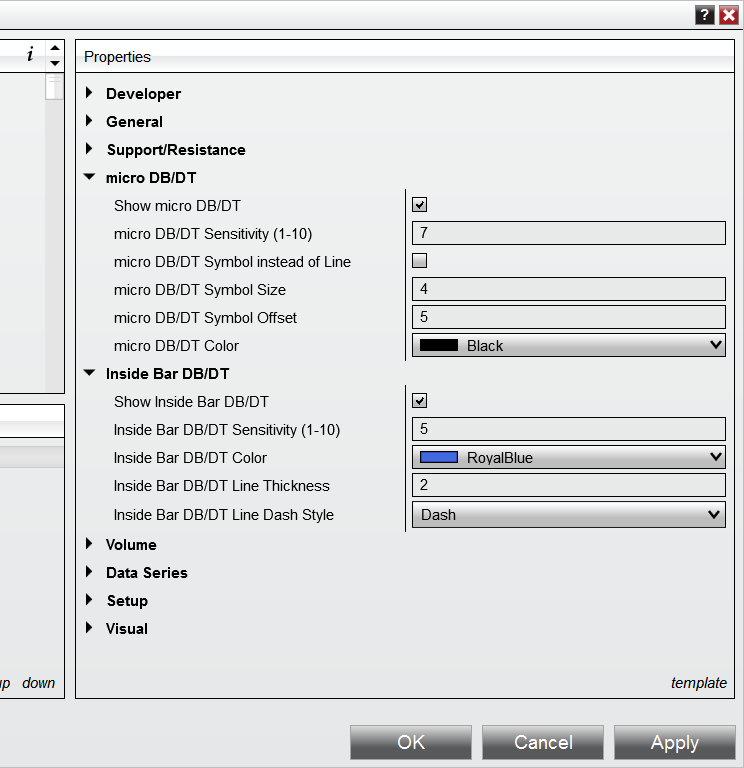

micro DB/DT

Show micro Double Bottoms and micro Double Tops. Adjust Sensitivity from 1 to 10 when detecting micro Double Bottoms/Tops. Higher values give more signals.

Inside Bar DB/DT

Show Inside Bar Double Bottom/Top with the Low or High of an Inside Bar or a large tail. Adjust Sensitivity from 1 to 10 when detecting Inside Bar Double Bottoms/Tops. Higher values give more signals.

Volume

Compares the volume of the current bar with the volume of the 1st Bottom/Top (“old” support or resistance. The “Volume Threshold” setting filters volumes below a certain percentage.

Please see also the section about volume above.

back to Indicators