E-mini ES 5 min RTH charts

Here are a couple of the latest blog posts, that highlight a couple of important signals of the S/R Breakout Failure indicator in context. To find out more about the other abbreviations or setups on the charts visit the corresponding blog pages or check out this post.

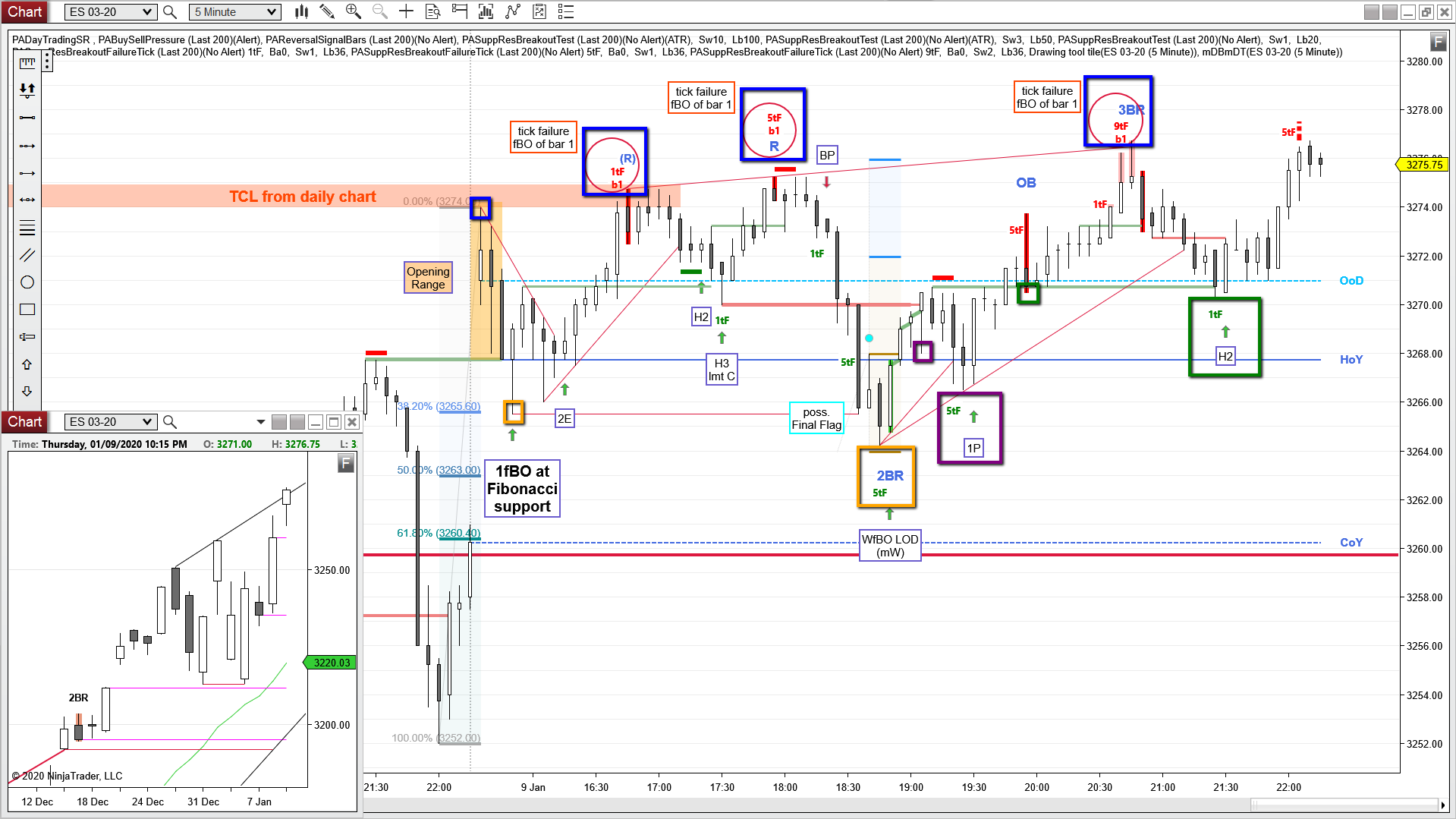

5tF of the 1st bar of the day (which is also the OR here) signals BB scaling in 4 ticks lower.

1tF above the HOD – SA.

5tF of a prior higher low, signals BB scaling in 4 ticks lower. Aggressive traders B the 5tF here lmt C.

1tF of a prior higher low, signals BB. Aggressive traders B here lmt C.

1tF of a prior higher low, signals BB. The confluence with a breakout test (green horizontal line) of a prior swing high makes traders B the bar’s close.

5tF of a swing low of the prior day, signals BB scaling in 4 ticks lower. Aggressive traders B the 5tF here lmt C, conservative wait for a bull SB.

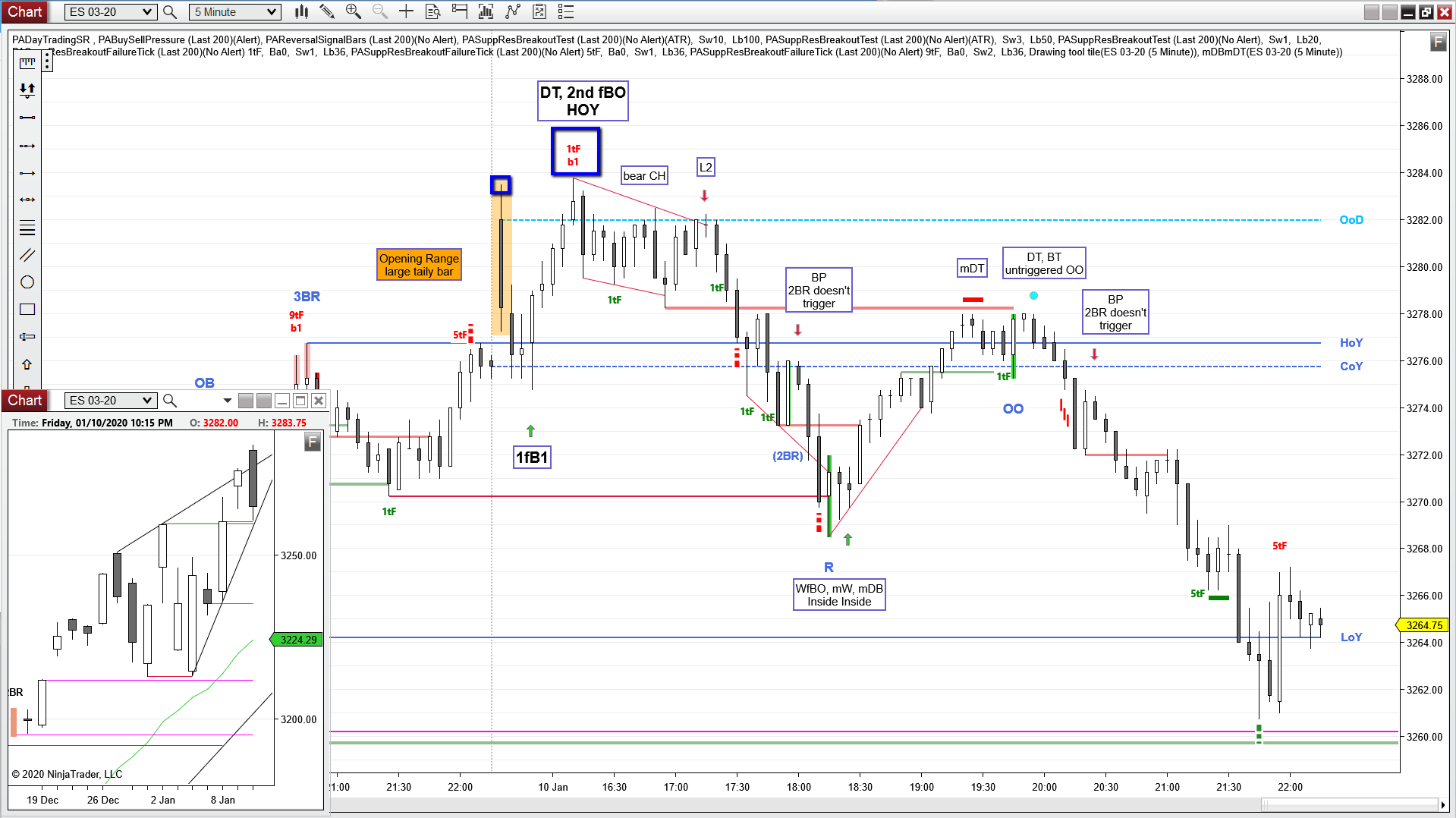

1tF of the 1st bar of the day (which is also the OR here) signals SA. Aggressive traders S here lmt C, conservative wait for a bear SB.

1tF of a prior higher low, signals BB. The confluence with a breakout test (green horizontal line) of a prior swing high makes traders B the bar’s close.

1tF of a prior lower high, signals SA. Because of the bull strength (five bars up), traders wait for a bear SB. Here the bear SB even was a 5tF above the bar with the 1tF.

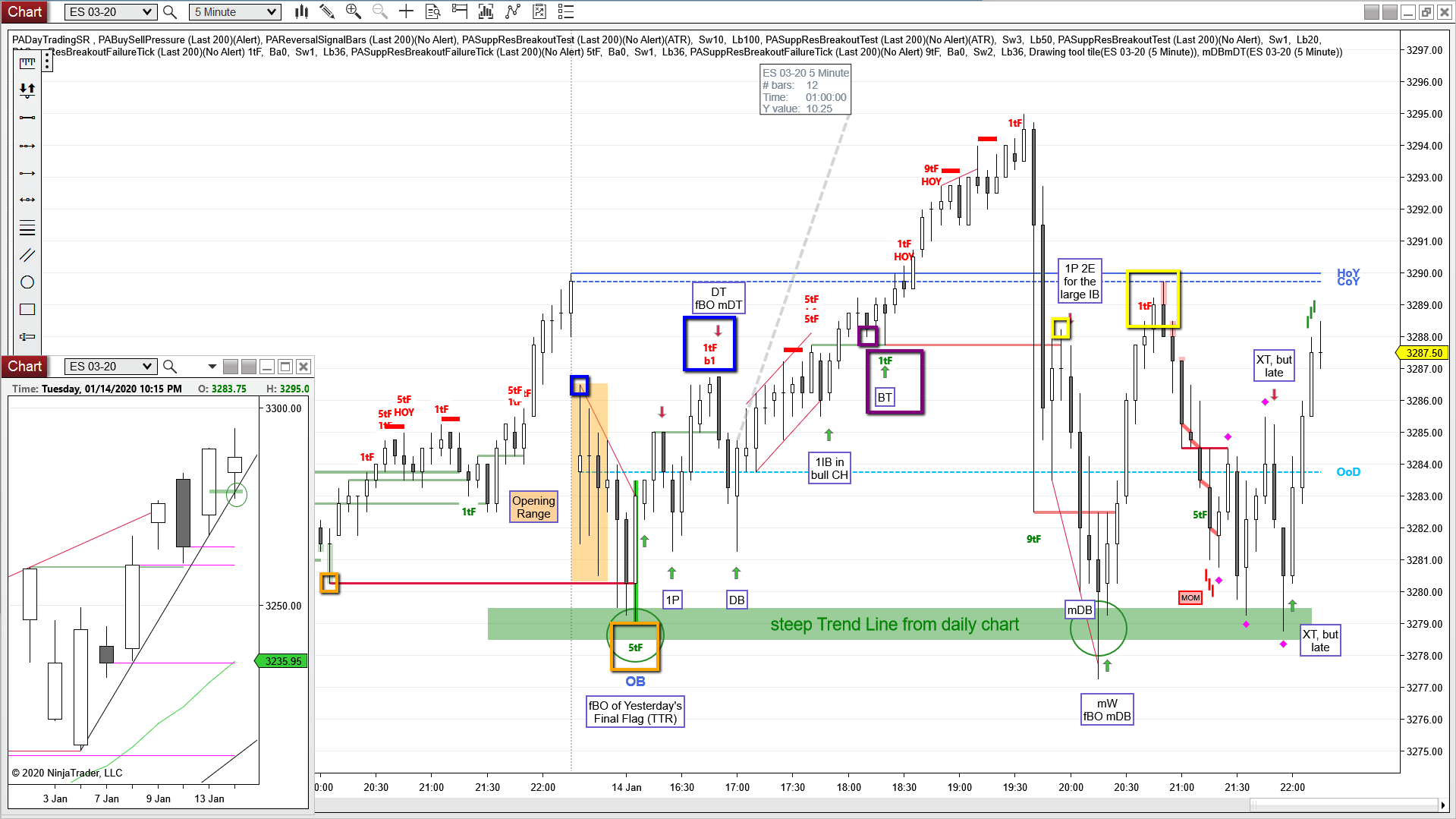

1tF of the 1st bar of the day (which is also the OR here) signals BB.

5tF of the 1st bar of the day signals more BB and bulls scaling in 4 ticks lower.

1tF of a prior higher low, signals BB. There is also confluence with a breakout test (green horizontal line) of a prior swing high. Bulls B above the bull Inside Bar.

1tF of the 1st bar of the day (which is also the OR here) signals SA. Here it becomes the HOD.

1tF of the 1st bar of the day (which is also the OR here) signals SA.

5tF of the 1st bar of the day signals more SA and bears scaling in 4 ticks higher.

9tF of the 1st bar of the day signals more SA and bears scaling in another 4 ticks higher.

5tF of the LOD signals BB and bulls scaling in 4 ticks lower. Conservative traders B the 2BR.

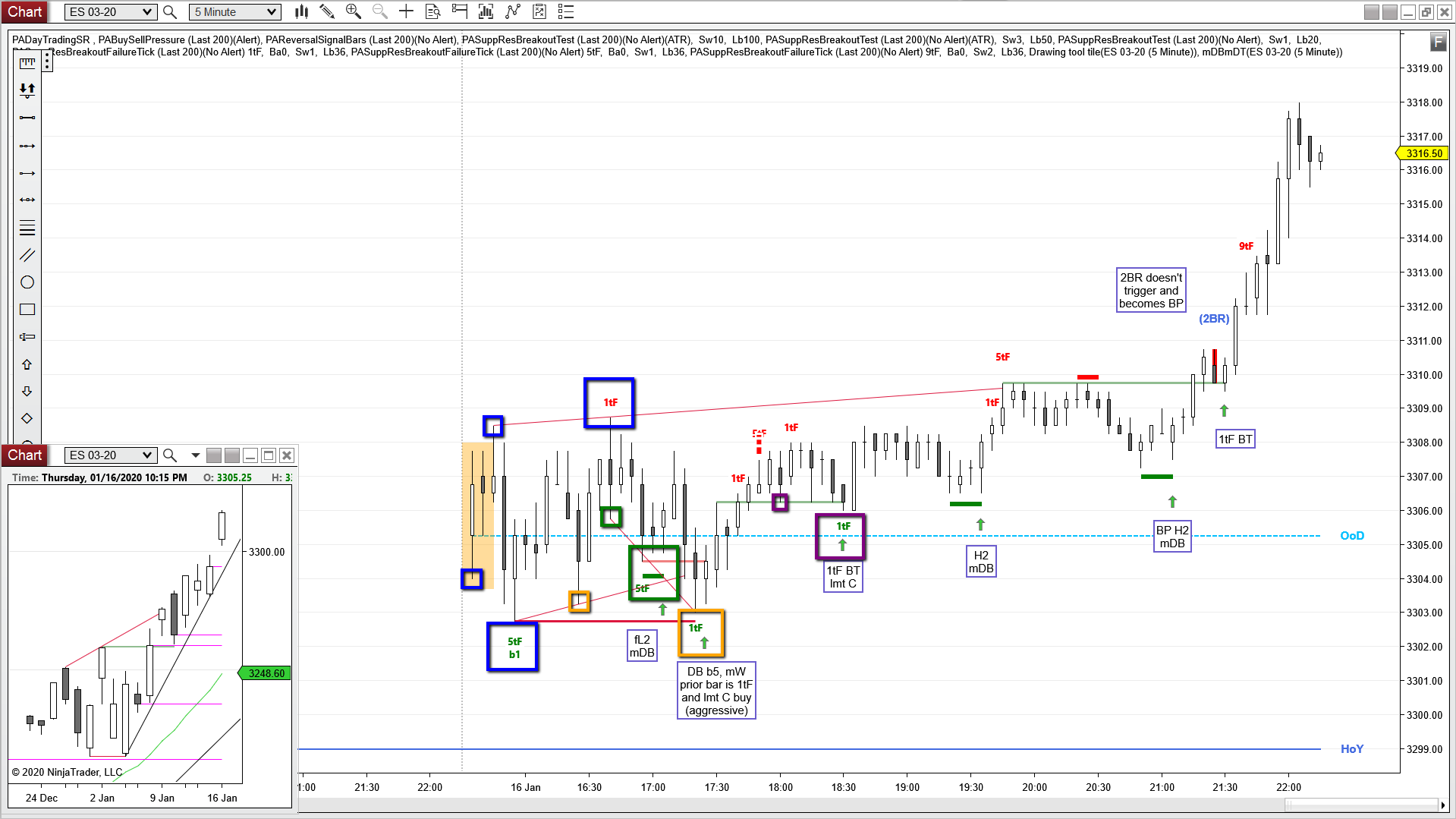

5tF of a prior higher low, signals BB and bulls scaling in 4 ticks lower. Conservative traders can wait for a bull SB.

Deep PB to an earlier BO point. 1tF of a prior higher low, signals BB. There is also confluence with a breakout test (green horizontal line) of a prior swing high. Bulls B the 2BR.

5tF of the 1st bar of the day (which is also the OR here) signals SA and bears scaling in 4 ticks higher. Conservative traders wait for a bear SB, which is a 1st fBO of the OR and the HOY. Here it’s also a perfect test of resistance (the prior ATH).

5tF of a prior higher low, signals BB. There is also confluence with a breakout test of the HOY. Bulls B above the impeccable bull RVB.

Here are a couple of tick failure breakouts in a bull micro channel. With so much bull strength it’s better to wait for a bear SB and enter on a SE below.

1tF of the 1st bar of the day (which is also the OR here) signals SA. There is no good SB to take a short trade. A couple of bars later you get a DT and a BP of that.

1tF of a prior higher low, signals BB. Conservative traders can wait for a bull SB and B above that.

9tF of a prior higher low, signals BB and bulls scaling in twice 4 ticks lower. Bulls B above the good bull RVB.

Please tell us what you think is missing, any kind of feedback is highly appreciated – contact us

Back to S/R Breakout Failure