Reversal Signal Bars & Patterns

Reversal Patterns

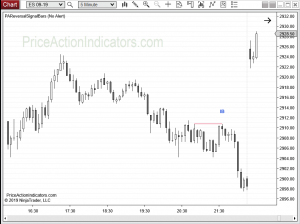

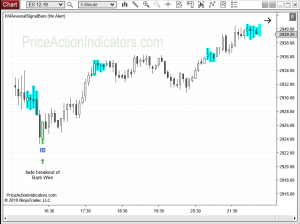

Multi-Bar Reversals – MBR

Multi-Bar Reversals (MBR) are reversals, where the market tries to reverse over the course of a couple of bars. For a bull reversal there is often a strong bear breakout followed by a strong bull breakout. Often there are a couple of pause bars in between the two breakouts or each breakout can be spread over several bars. It is best if the reversal up is bigger than the sell off down.

Sometimes there is a reversal bar or pattern (a two or three bar reversal) on a higher time frame, e.g. the 30 min chart for a multi-bar reversal that takes place during six bars on the 5 min trading chart.

Entries on a MBR should be taken with some discretion. If the MBR is large its better to take a pullback entry. Advanced entry strategies are to BB and SA with a Signal Bar or with limit orders.

Inside Bar – IB

An Inside Bar is a counter trend bar with a bullish close, contained by the prior bar. Inside Bars are excellent Signal Bars for a failed breakout, good continuation signals at the end of a pullback and work better at a higher low or a lower high. They should be avoided in overlap.

Sometimes you get an Inside Bar Reversal. The most important criteria to trade a reversal off an Inside Bar is a trend channel line overshoot (TCLOS) or better a 2nd TCLOS and that the entry still leaves room for a profitable trade to the other end of the bar, that contains the inside bar.

The classic stop entry for a bull Inside Bar is one tick above it’s high and the bar stop loss is one tick below it’s low. The next (wider) stop loss would be below the low of the bar that contains the Inside Bar.

A Small Inside Bar (even with a weak close) at one end of a large bar is a setup for a fade of the large bar. At times its fine to fade a large bar off a same colored inside bar, if the entry is within the direction of the overall trend or has some other strengtheners. The 1st target for that fade is the other end of the bar, that contains the Inside Bar.

Reversal Bar – R

A Reversal Bar (also called Pin Bar) is a bar with a bottom tail, a close above mid bar and open. Relatively small Reversal Bars often fail and your’e better off waiting for a second entry. A Reversal Bar should have at least two ticks underlap (for a bull Reversal Bar – it’s tail to go at least two ticks below the prior bar). It shouldn’t have a lot of overlap with prior bars. A Doji before a Reversal Bar weakens the signal.

The classic stop entry for a bull Reversal Bar is one tick above it’s high and the bar stop loss is one tick below it’s low.

Inside/Inside Pattern – II

An Inside Inside Pattern is a larger bar, that contains two consecutive Inside Bars. The pattern is often a trading range or triangle on a smaller time frame and area of equilibrium.

If the highs or the lows of all three bars have about the same price Inside Inside patterns are often micro double tops or bottoms.

The classic stop entry for a bull Inside Inside Pattern is one tick above the high of the last Inside Bar and the stop loss is one tick below the lowest low of both Inside Bars or one tick below the low of the bar, that contains both bars.

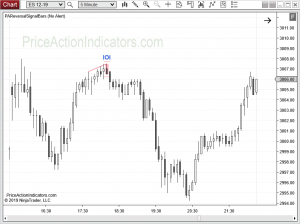

Inside/Outside/Inside Pattern – IOI

An IOI pattern consists of an Inside Bar followed by an Outside Bar and another Inside Bar. It is often a second counter trend entry (a second attempt to reverse).

The classic stop entry for a bull Inside/Outside/Inside Pattern is one tick above the high of the Inside Bar and the stop loss is one tick below the low of the Inside Bar or one tick below the low of all three bars.

Outside/Inside/Outside Pattern – OIO

An OIO pattern consists of an Outside Bar followed by an Inside Bar and another Outside Bar. The last Outside Bar is often acting as a trap, by triggering the Inside Bar, then triggering below it and finishing with a bull close (for a bullish reversal pattern). This trap can result in a sharp move. An OIO is a Reversal Bar on a higher time frame.

The classic stop entry for a bull Outside/Inside/Outside Pattern is one tick above the highest high of all three bars and the stop loss is one tick below the lowest low of all three bars.

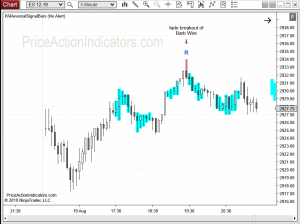

Two Bar Reversal – 2BR or 2R

A Two Bar Reversal (2BR) is a pair of trend bars with opposite colors. A Bear Trend Bar followed by a Bull Trend Bar is a bullish reversal pattern. These two bars resemble a reversal bar on a higher time frame. A 2BR should be clear and beyond any overlap with the prior range. If a 2BR occurs in a pullback, take a second entry (2E).

The classic stop entry for a bull Two Bar Reversal Pattern is one tick above the highest high of both bars and the stop loss is one tick below the lowest low of both bars.

Three Bar Reversal – 3BR or 3R

A Three Bar Reversal consists of a Bear Trend Bar, followed by a pause bar (e.g. a Doji) and a Bull Trend Bar (bullish reversal pattern). These three bars often resemble a Reversal Bar on a higher time frame.

The classic stop entry for a bull Three Bar Reversal Pattern is one tick above the highest high of all three bars and the stop loss is one tick below the lowest low of all three bars.

Outside/Outside Pattern – OO

An Outside/Outside pattern consists of two consecutive Outside Bars and can be a reversal or continuation pattern depending on context. The pattern often acts as a double trap.

The classic stop entry for a bull Outside/Outside pattern is one tick above the highest high of both bars and the stop loss is one tick below the lowest low of both bars.

Outside Bar – OB

An Outside Bar is a bar, where the high of the bar is above the high of the prior bar and the low is below the low of the prior bar. Outside Bars can act as reversal or continuation patterns depending on context.

The classic stop entry for a bull Outside Bar is one tick above it’s high and the bar stop loss is one tick below it’s low.

Final Flag (FF)

A Final Flag signifies sudden loss of momentum, a horizontal, overlapped pattern after a trend (the last PB before a possible trend break or reversal). It can be one bar or a couple of overlapped sideways bars. A breakout often fails and tries to reverse the trend.

The Reversal Signal Bars indicator shows Final Flags from Inside, Inside Outside Inside and Inside Inside Bar signals, that trigger on the “wrong” side and might act as a Final Flag. One Bar Final Flags are indicated on the prior bar (after a breakout from the possible Final Flag) and aren’t suitable signals for Automated Trading (with BloodHound). The 1st target for the failed breakout is the other end of the FF.

Inside Inside failed Breakout – II fBO

An Inside Inside Pattern are two consecutive Inside Bars. The pattern is often a trading range or triangle on a smaller time frame and an area of equilibrium. A breakout often fails and tries to reverse back into the II pattern.

The stop entry for a bull II fBO Signal Bar is one tick above the high of the bar and the stop loss is one tick below it.

Continuation Patterns

Often there are Breakout Pullbacks after a Reversal (continuation within new trend or a trend attempt).

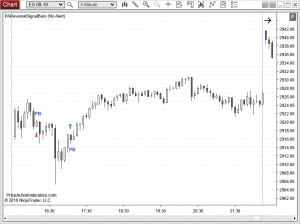

Inside Bar Breakout Pullback – PB

An Inside Bars after a breakout can be treated as a Breakout Pullback and can be entered with trend. Some of the signals might end up being the Final Flag of a trend (see above). That’s why on some Inside Bar Breakout Pullbacks you will also see a signal for a Final Flag. Some of them are also small Inside Bars (see above) for a fade of the large breakout bar and can trigger in the “wrong” direction. If you want to trade both directions, they can be bracketed.

The classic stop entry for a bull Inside Bar Breakout Pullback is one tick above the Inside Bar and the closest stop loss is one tick below the lowest low of both bars.

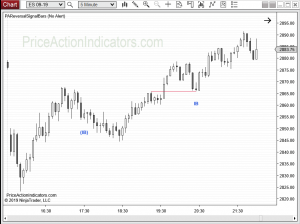

Two Bar Breakout Pullback – 2PB

A Two Bar Breakout Pullback is another version of a breakout pullback and can be entered with trend. Counter trend traders tried to make a stand, but failed two times. Below are a couple of examples with the stop entry and a possible stop loss price marked up.

The classic stop entry for a bull Two Bar Breakout Pullback is one tick above the highest high of both bars and the closest stop loss is one tick below the lowest low of both bars.

Inside Outside Inside Continuation – IOIC

An Inside Outside Inside Continuation pattern is another version of an Inside Outside Inside reversal pattern. It occurs as a pullback in a trend or after a trend attempt.

The classic stop entry for a bull IOIC is one tick above the last Inside Bar and the closest stop loss is one tick below the lowest low of all three bars.

Inside Inside Pullback – II PB

An Inside Inside Pullback pattern is an Inside Inside pattern after a breakout, that is likely to continue in the direction of the breakout. The pattern is often a trading range or triangle on a smaller time frame, a bull or bear flag pattern.

The stop entry for a bull II PB is one tick above the Signal Bar and the stop loss is one tick below the low of the breakout bar, the bar before the Inside Inside pattern.

Entry Bar (E) and Breakout Bar (B)

The bar, that moves past the range of the Reversal Signal Bar or Pattern triggers the entry order and puts the trader into that trade. This bar becomes the Entry Bar. If there is no decent Entry Bar (a strong Trend Bar), one can look to trade a Breakout Bar after the Reversal Signal Bar or Pattern.

Entering a trade after a strong Entry or Breakout Bar raises the probability of success.

Failed Entry Bar (fEB)

The bar, that moves past the range of the Reversal Signal Bar or Pattern triggers the entry order and puts the trader into that trade. This bar becomes the Entry Bar. If the Entry Bar closes back within the range of the Reversal Signal it’s considered a failed Entry Bar.

The safest way to trade a fEB is to enter, when the Reversal Signal fails. e.g. a stop entry below the low of the Reversal Signal. Watch out for a 2nd attempt from the reversal traders!

Tick Failure Breakouts strengthen a failed Entry Bar, like a 1 or 2t failed Breakout, or a failure to fill a common target from the Reversal Signal.

What to do with “Barb Wire”?

Barb Wire is a special kind of a tight trading range, where the price action is confined to a narrow range made up of small bars, many of which are dojis. If Barb Wire occurs just before a Reversal Signal, it can decrease the probability of a profitable trade.

Without a lot of experience it’s best to avoid trading “barb wire”. There is no real way to trade “barb wire” except to fade a breakout of it. This is because “barb wire” is a tight trading range and most trading range breakouts fail. Here is bit more to read: Nine Transitions Blog on “Barb Wire”

Signal Bars & Patterns

Entry strategies

How to Trade

Automated Trading

More Charts

Please tell us what you think is missing, any kind of feedback is highly appreciated – contact us

Back to Reversal Signal Bars