Support and Resistance – Opening Range

Indicator for NinjaTrader® 8 ONLY!

Features

- Calculate the Opening Range High/Low for the first 5, 15, 30 or 60 minutes of the trading session

- Show bars from higher time frames (5, 15, 30 and 60 minutes) on the trading chart

- Show closes from higher time frame bars on the trading chart

- Show the open of the day

- Alert feature for a close above/below the Opening Range

- Real-time signals (Calculate: On price change)

- does not work on Second, HeikenAshi, Kagi, Renko, PointAndFigure and LineBreak charts

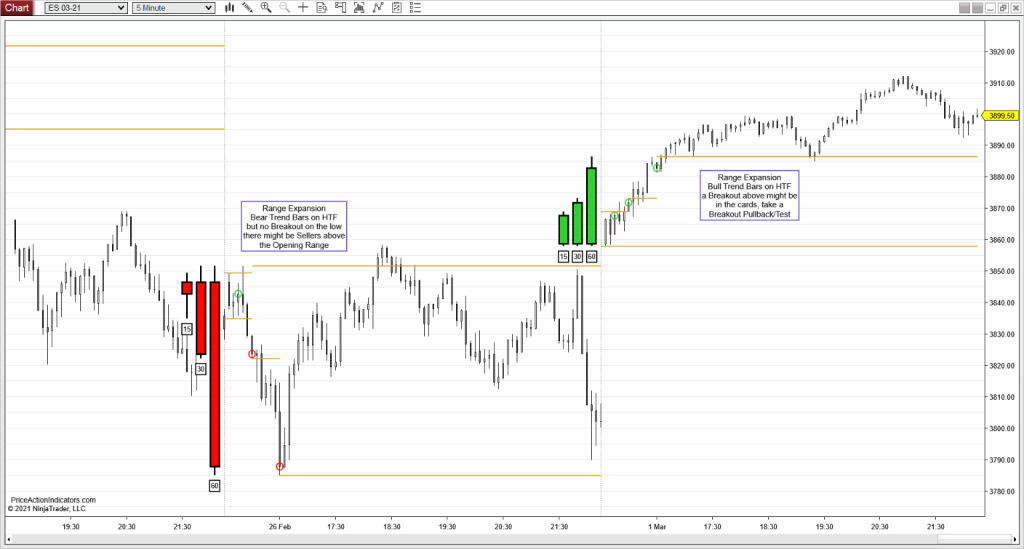

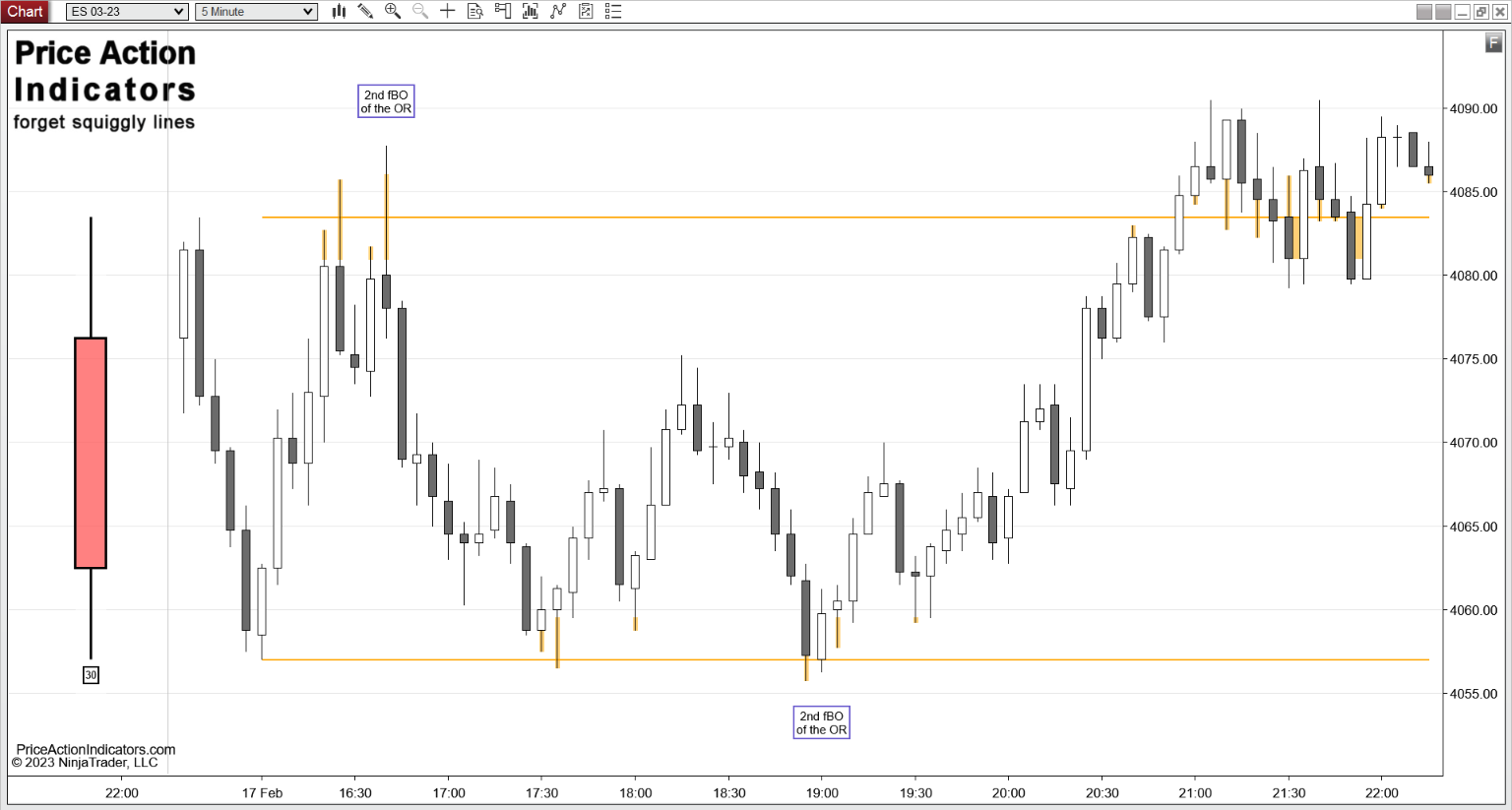

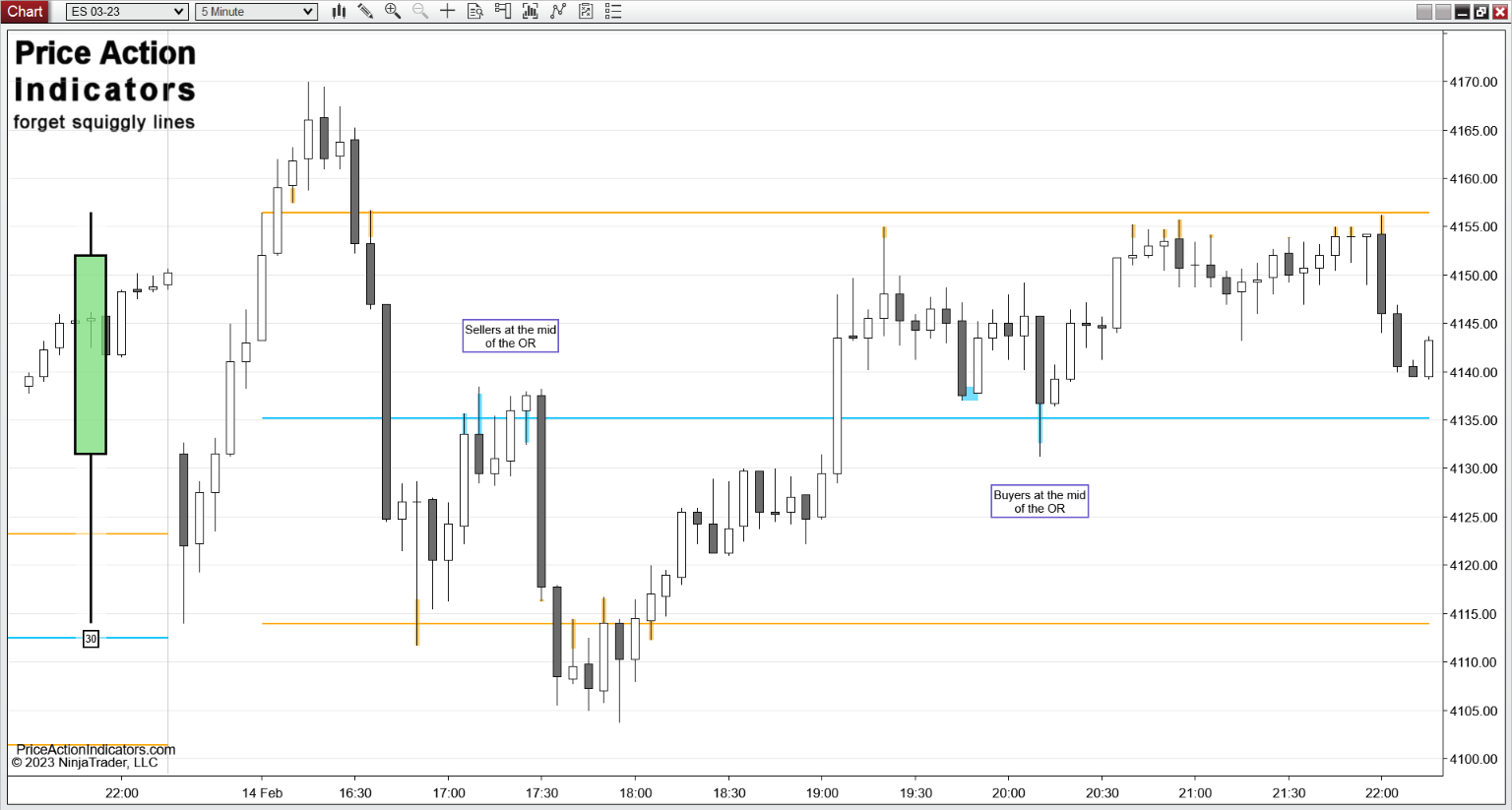

Example Charts

Download a 20 day trial version

Buy now for US $ 80

you get redirected to our reseller MyCommerce/Digital River/Share-it to place your order

to order you need your NinjaTrader® Machine ID (please see FAQ)

for license activation (please see FAQ)

Please contact us for a discount if you’re going to buy more than one indicator.

What is Support and Resistance?

Support and resistance are important levels where lots of buyers and sellers are willing to trade a security. If these levels are broken, market psychology can shift and new levels of support and resistance might get established. Although single lines look nice on a chart, levels need to be seen as zones.

Like Al Brooks is saying here “One of the most useful rules in trading is that if something resembles a reliable pattern, it will likely behave like the reliable pattern. In any case, nothing is ever perfect or certain, so close is usually close enough.”

The Opening Range

Opening Ranges are important to a lot of traders because they often provide an indication of sentiment for the day’s price action. A number of trading systems rely on breakouts or failed breakouts of the extremes of the opening range.

The PAOpeningRange indicator is able to calculate the Opening Range High/Low for the first 5, 15, 30 or 60 minutes of the trading session.

It also shows the candle sticks for all of the higher time frames selected to point to a possible change of sentiment during the forming of the opening range. Closes from the higher time frame bars can be plotted on the trading chart to spot aggressive trading at these important prices.

Well know strategies used to trade the opening range are High Volume Breakout, Breakout Pullback / Breakout Test and Failed Breakouts.

Increase the probability on these strategies by considering the following:

- do not trade into support & resistance of the prior day

- trade in the direction of VWAP

- on large gaps breakouts often lack conviction

Because of the increase in volume around the “old RTH open” it might even make sense to trade markets like Crude Oil (CL) or Gold (GC) using the RTH Opening Range, despite that there are no “real” RTH on these instruments anymore.

Price Action around important levels of the Opening Range

If price is close to the High/Low or middle of the Opening Range Price Action at the corresponding support/resistance level can be highlighted. Pullbacks or Tails at these levels can be highlighted also.

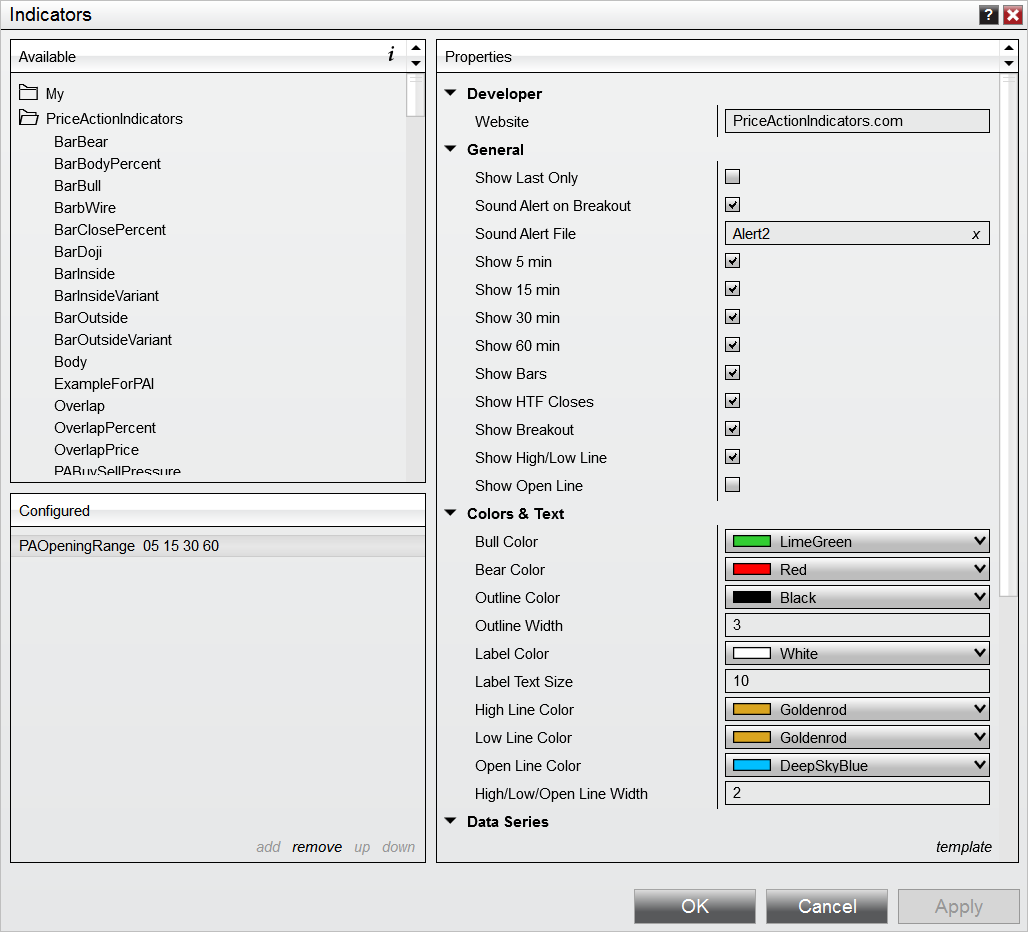

What are the settings?

Indicator name: PAOpeningRange

Show Last Only

Show the indicator signals only for the last couple of days which will speed up a reload of the chart and indicator

Sound Alert

Play a sound and show an alert in the alert window when there is a close above/below the opening range

Sound Alert File

Pick a .WAV file from the NinjaTrader sound folder (how to install sounds, see here )

Show 5 / 15 / 30 / 60 min

Opening range high/low for the first 5, 15, 30 or 60 minutes of the trading session

Show Bars

Show bars from higher time frames (5, 15, 30 and 60 minutes) on the trading chart

Show HTF Closes

Show Closes from higher time frame bars on the trading chart

Show Breakout

Mark bars, that close above/below the opening range

IMPORTANT:

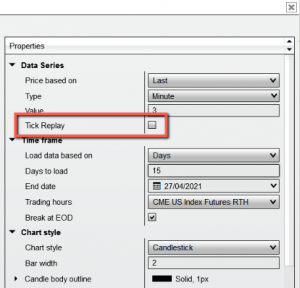

Because this indicator is using a “Multi-Time Frame” approach and because of Ninja Trader’s Data processing sequence for historical data one needs to set the Data Series of the chart to “Tick Replay“ to get reliable signals for a breakout of the Opening Range (on historical data only). Please read more here: How to enable “Tick Replay”.

Show High/Low Line

Show the opening range high/low as a horizontal line

Show Open Line

Show the open of the day as a horizontal line

Bull Color

Fill color for higher time frame bull bars

Bear Color

Fill color for higher time frame bear bars

Outline Color

For higher time frame bars

Outline Width

For higher time frame bars

Label Color

Color for the higher time frame bar label

Label Text Size

Text size for the higher time frame bar label

High Line Color

Color for the high line of the opening range

Low Line Color

Color for the low line of the opening range

Open Line Color

Color for the line at the open of the day

High/Low/Open Line Width

back to Indicators