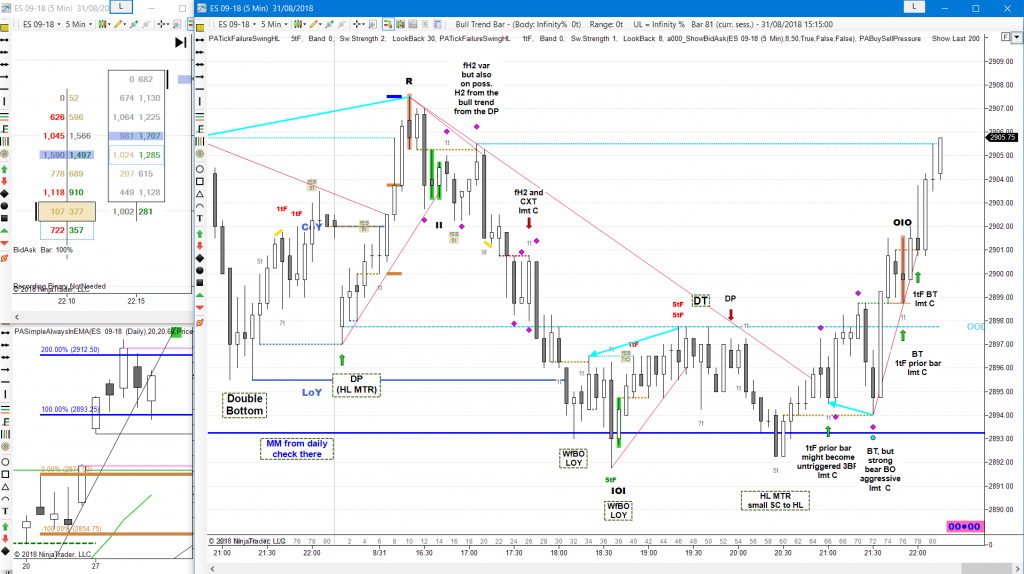

Bear gap, mid range, DP, bull CH, MC, fH2, CXT, WfBO LOY, HL MTR, BT, 1tF BT, DT

again, can see nicely, how we bounced off of S/R from the daily chart

daily chart

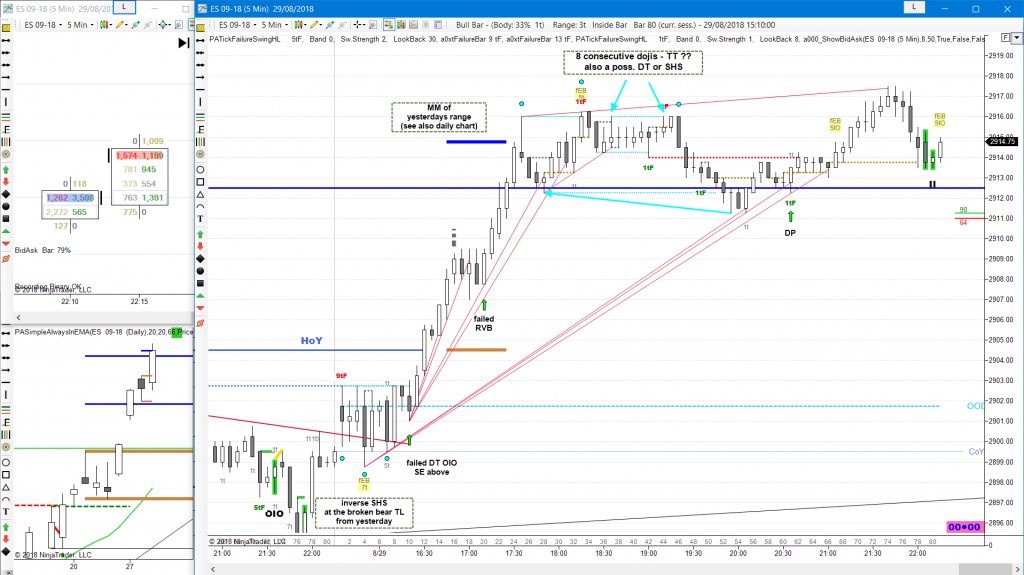

a poss. HL and BO PB

Why are the MMs from the daily chart S/R?

MMs of PBs are “bread and butter” MMs (easy to see and understand)

bulls who B the BO (2874) on 08/24 have PT of e.g. one (2893) and two times (2912) their risk

risk for them is the L of the PB before BO (2855)

bears know/expect that, short at the poss. MM target and scale in higher (e.g. at the 1st and 2nd target, one and two x MM)

bears then get out/PT at their 1st entry (2893, 1xMM) Continue reading “E-mini ES 2018/08/31”