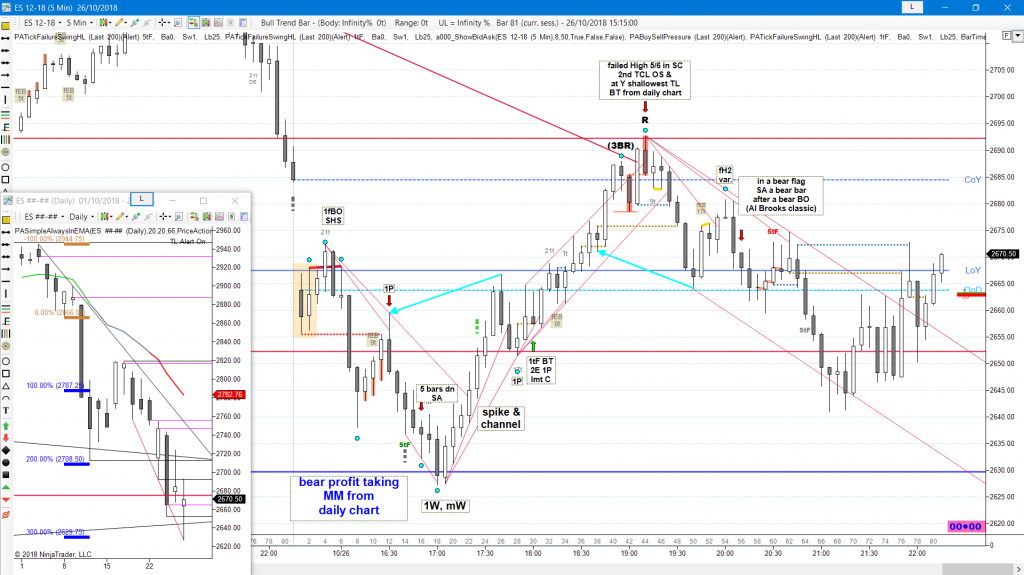

E-mini ES 2018/10/30

Continuation, failed XT, DB, DP, large fL2, XT, HL MTR, BP, BB, SC

(the BP is no II)

daily chart

IOI for the bulls, a 2E at the TRI TL

some bears probably will exit, if that triggers (some above the HOY, some above the high of the entire pattern)

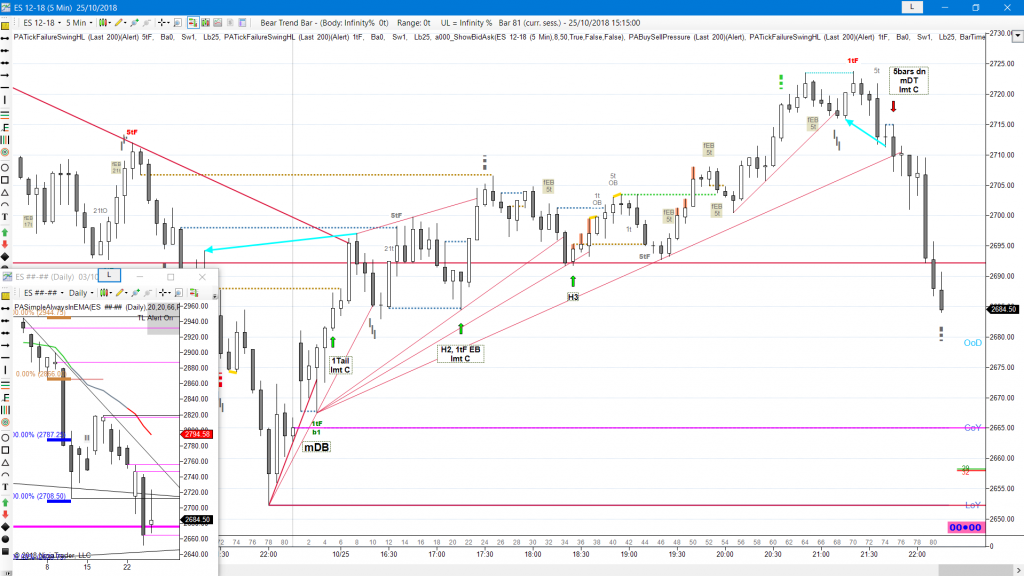

E-mini ES 2018/10/29

Bull gap, mid range, bear CH, 1fBO, L2, fBO, fH2, DT, 1Tail, BP

daily chart

bears PT at 1xMM of the last PB (a classics risk/reward based trade)

you short the BO (stop entry) of the extreme of the trend and place your stop loss above the last LH, then PT at 1xMM of your risk

in a bear trend this trade has a probability of > 50% so you have a positive traders equation