Always In Long/Short

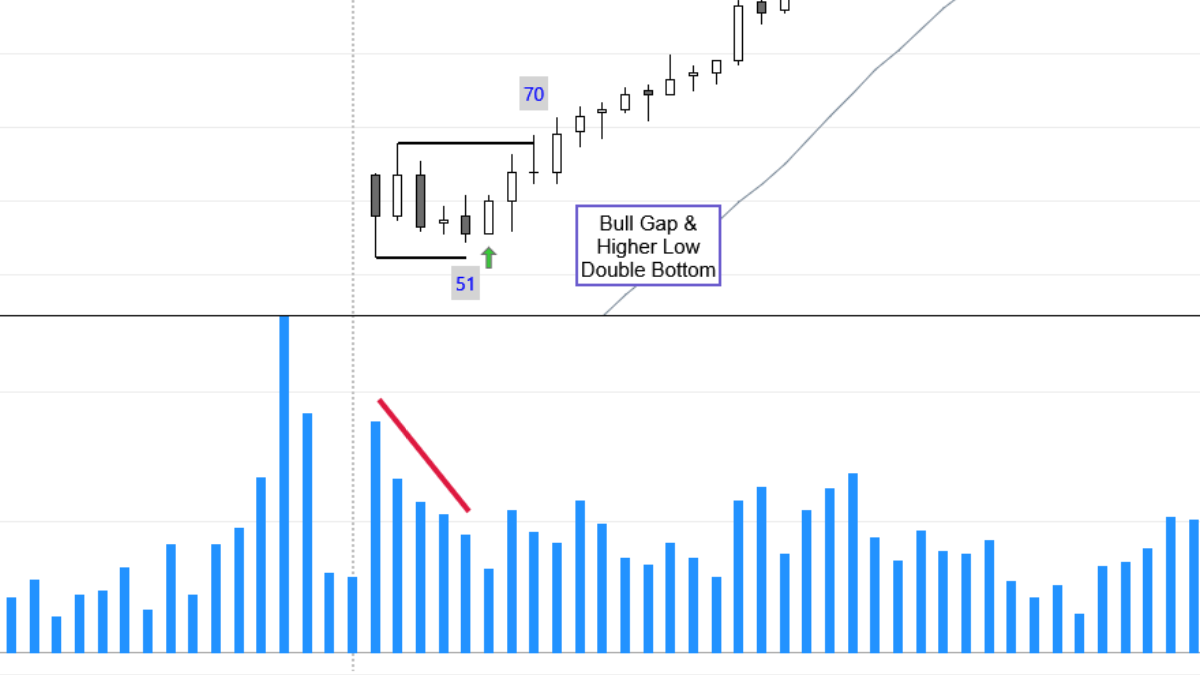

Use Volume for better Signals

For some time now, I’m experimenting with volume to improve the entry signals of the Price Action Indicators.

Decreasing or less volume, when approaching an old support or resistance shows a lack of interest from professional money to participate at these areas and prices are more likely to reverse.

Trade the 1st Pullback after a Wedge – the W1P!

A Wedge reversal (three or four pushes each with a new extreme) forming at the top or bottom of a trend is probably the most successful setup for a swing trade.

A Wedge reversal (three or four pushes each with a new extreme) forming at the top or bottom of a trend is probably the most successful setup for a swing trade.

The most crucial prerequisite for a Wedge reversal is a clear trend channel line overshoot and in particular a second overshoot.

Other strengtheners / requirements are: Continue reading “Trade the 1st Pullback after a Wedge – the W1P!”

What to do with “Barb Wire”?

“Barb Wire” is a special kind of a tight trading range, where the price action is confined to a narrow range made up of small bars, many of which are dojis (large tails and small bodies). Continue reading “What to do with “Barb Wire”?”