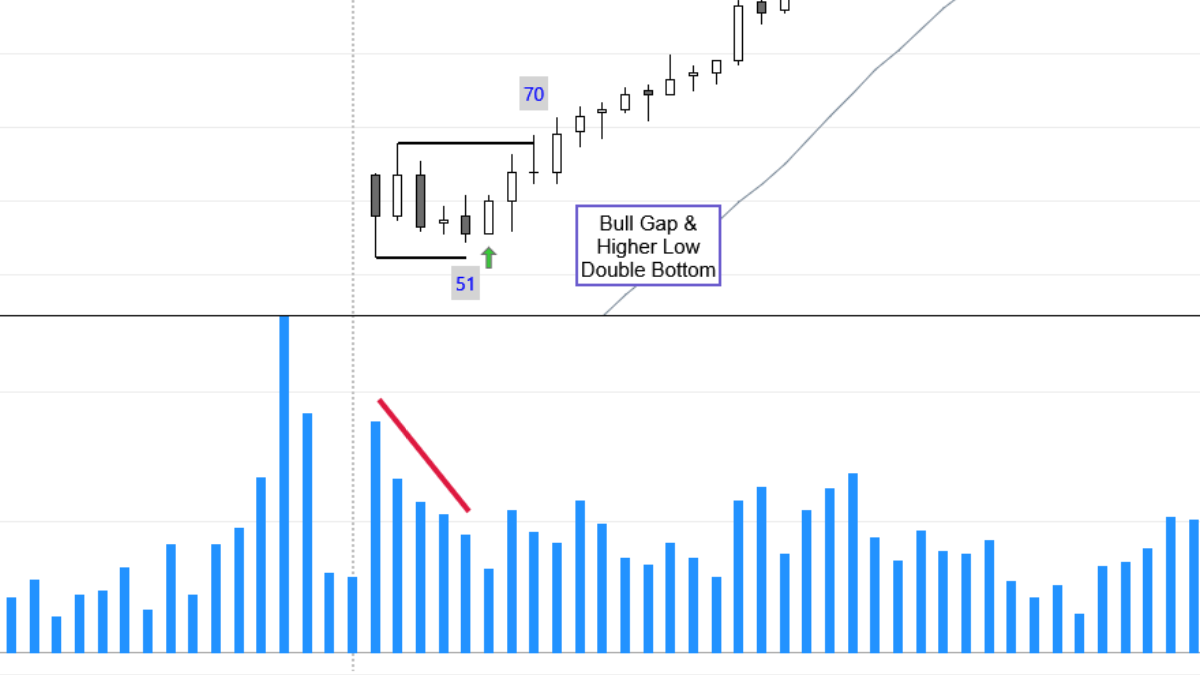

For some time now, I’m experimenting with volume to improve the entry signals of the Price Action Indicators.

Decreasing or less volume, when approaching an old support or resistance shows a lack of interest from professional money to participate at these areas and prices are more likely to reverse.