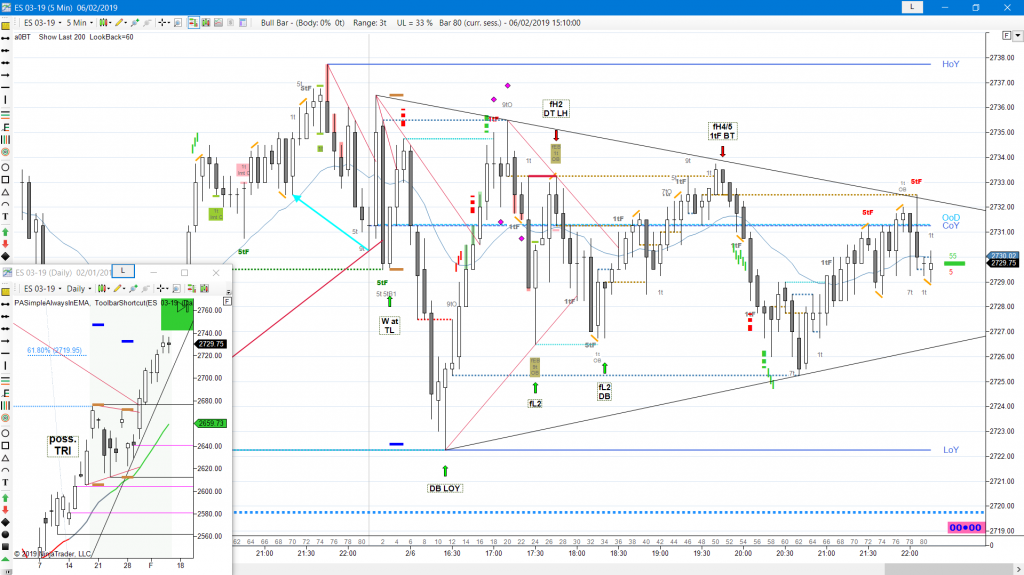

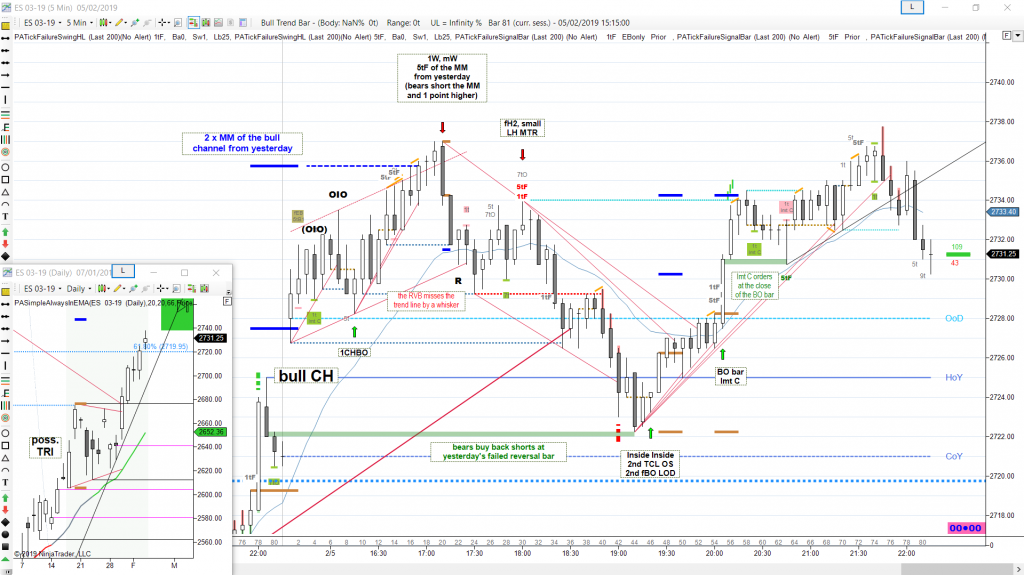

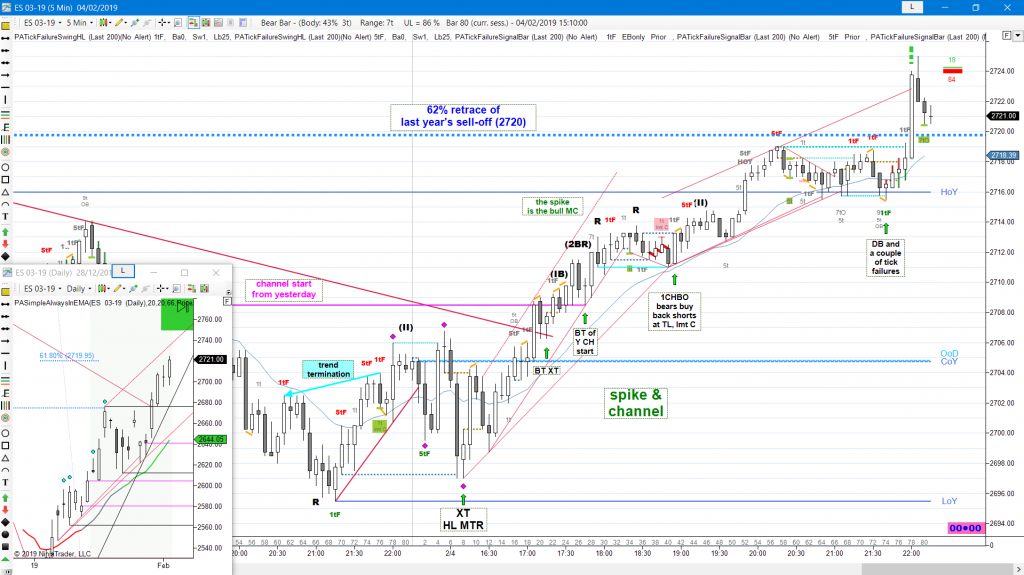

Always In Long (AIL) since 01/04

bears still might see a shallow wide bear channel below 2800, this wide channel can also be the channel part of a spike & channel trend pattern (the spike was the strong breakout from the double top at the all-time high)

bulls have a strong move up from the failed breakout of last year’s trading range low, but this might be only a “mini” trend within the large trading range

price formed a triangle a couple of days ago, which might act as a final flag (a trend termination pattern) in that “mini” bull trend