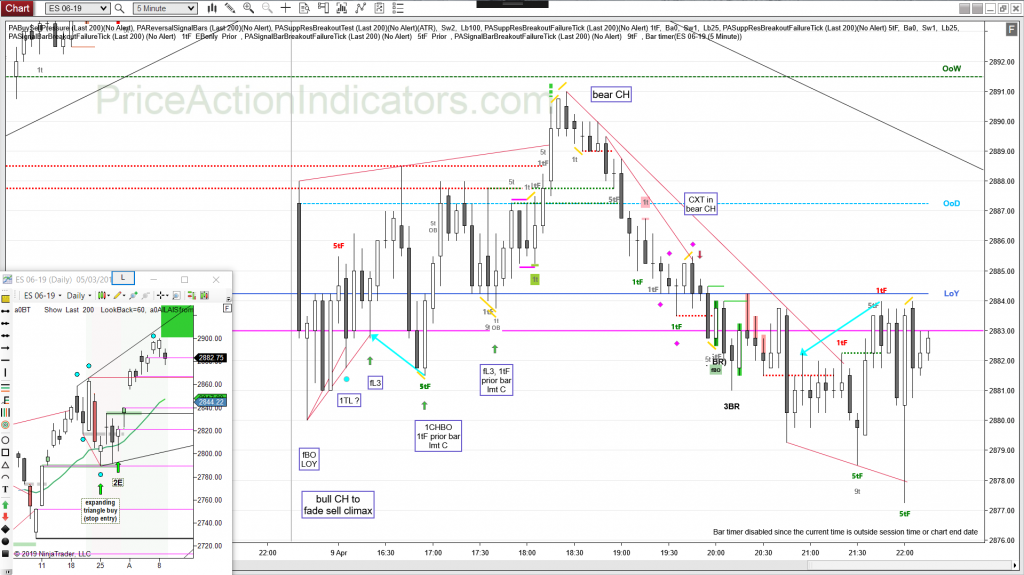

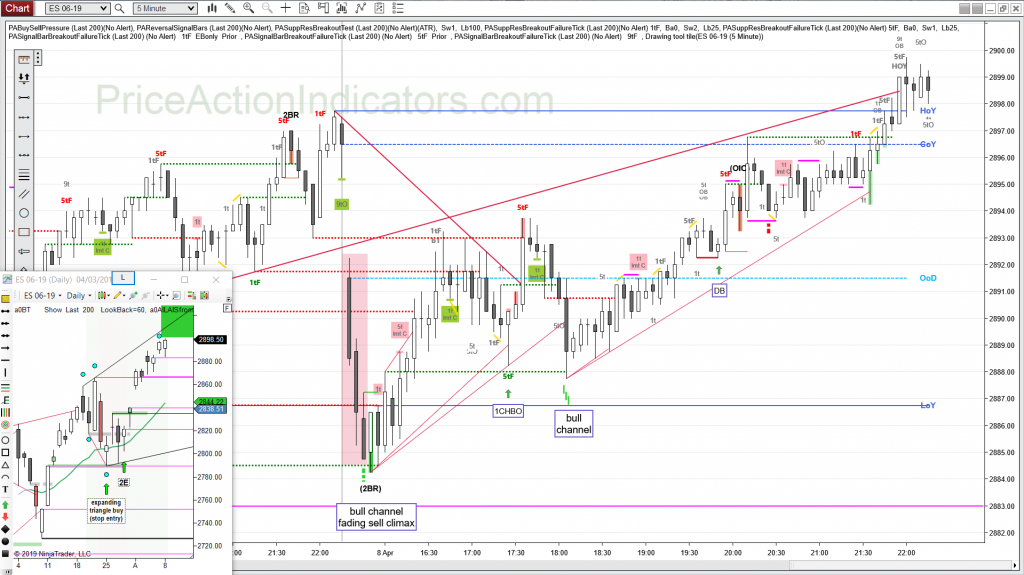

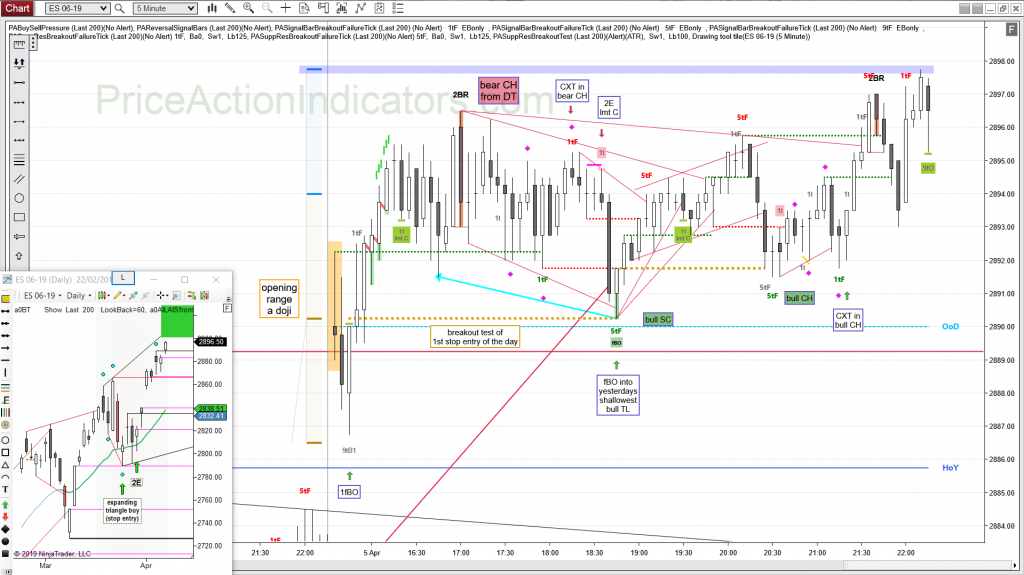

bear gap, mid range, SX, fBO LOY, bull CH, 1TL, fL3, 1CHBO, bear CH, CXT

bulls tried the same as yesterday, fading a bear BO with a bull CH –

spike and reverse channel – a classic

after a spike there is often a channel, but this channel doesn’t have to be necessarily in the direction of the spike

the spike can also act as a trading range and the reverse channel starts from a 1st or 2nd failed breakout of that spike (the trading range)

the target is the other end of the spike (the origin)

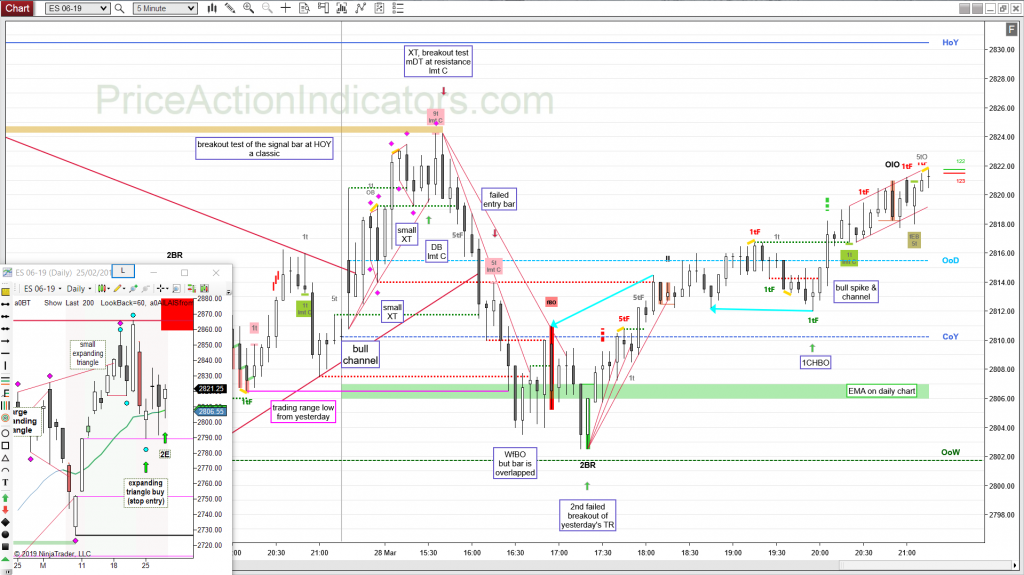

daily chart

Always In Long (AIL) since 03/29

again buyers below the prior bar and Thursday’s gap price

round number 2900 is still looming, but a whisker is missing on the future as well as on the index