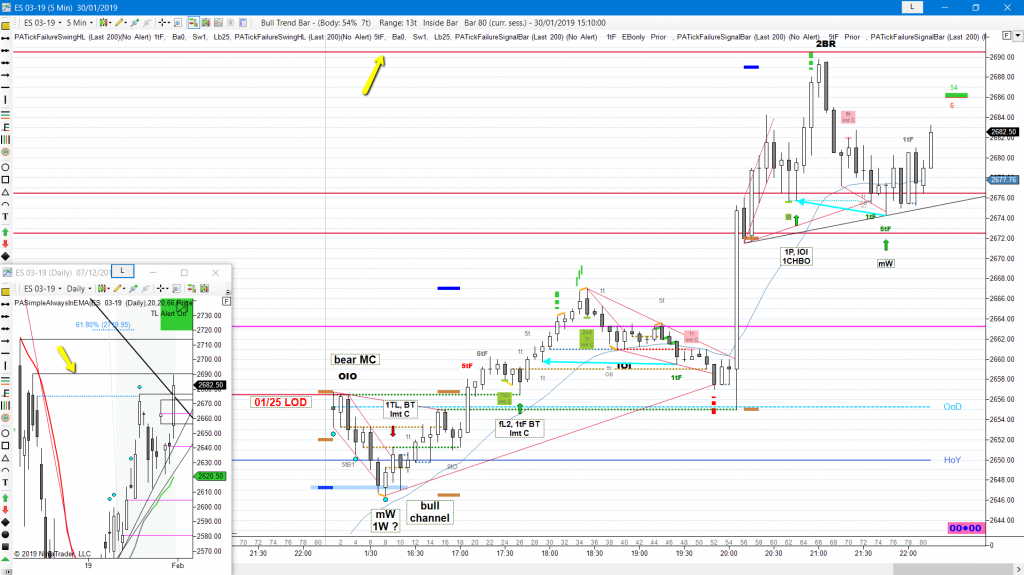

Bull gap, above HOY, bear MC, 1TL, mW, 1W, bull CH, fL2, 1tF BT, 1P, 1CHBO

FOMC report

daily chart

Always In Long (AIL) since 01/04

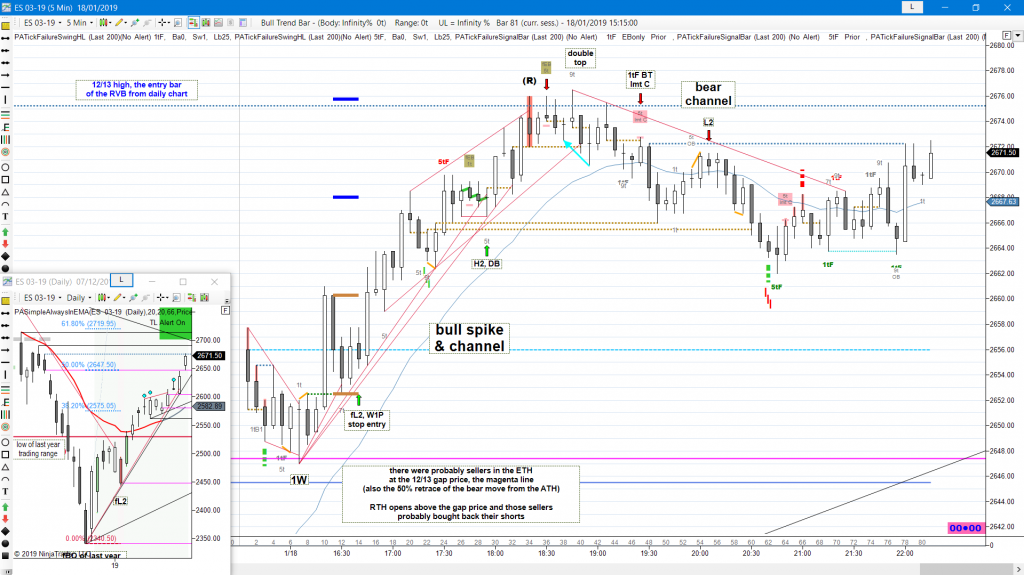

bulls BO above last weeks high and closed above, but Srs near the 12/12 swing high, which was a LH in the bear trend from last year

bears see DT with 12/12 LH