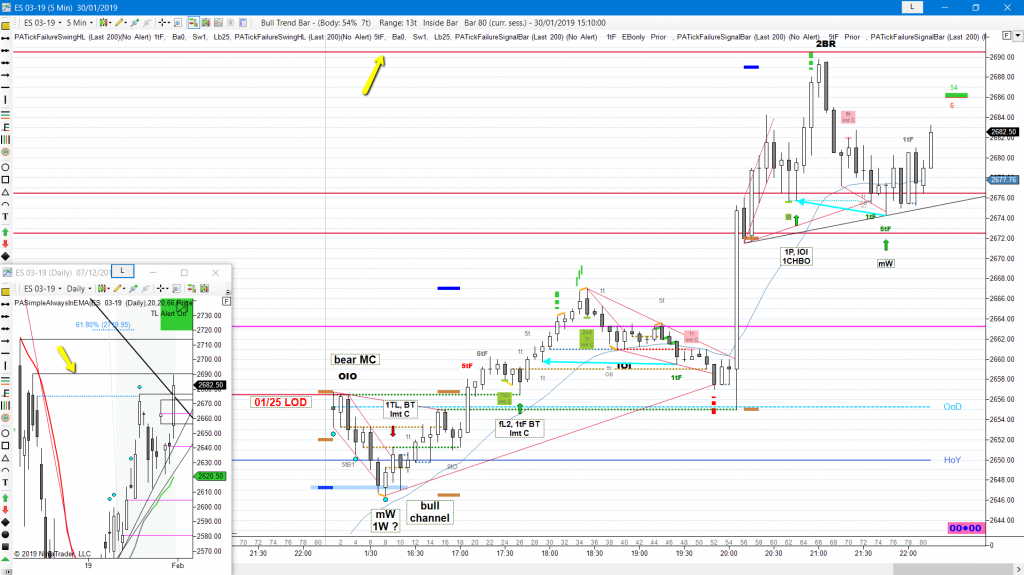

Continuation, mDT, 1W, XT, DB, 1CHBO, 1P

whipsaw at the LOY, then two pushes dn to a DB with 03/15, bull MC and BO during report, FOMC report

daily chart

Always In Long (AIL) since 03/12

bears shorted below yesterdays RVB and higher (around the open)

bulls managed to close above the last swing of the large XT and above that minor swing from last week