better call them Guidelines 🙂

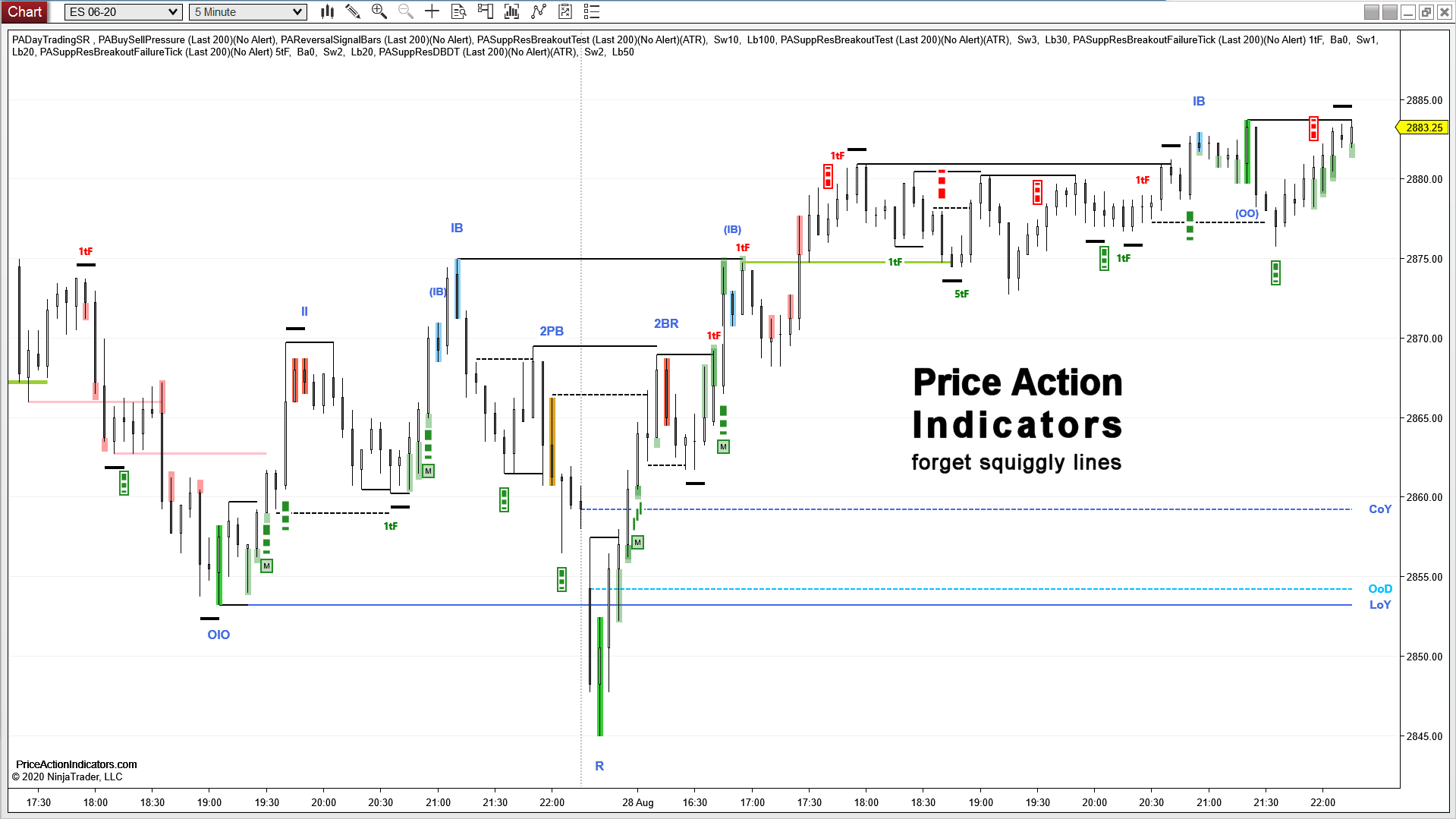

The open starts with either a trend or a trading range.

Trading Range

- Basically bar 2 tells you if you are in a trend or a trading range.

- When you get bar 1&2 in opposite directions, you already know this is probably a trading range.

- If bar 1 is a large bar with tails on both ends, it is a possible trading range bar.

- An outside bar 2 is also signalling trading range price action.

- A misplaced Reversal Bar (e.g. a bull RVB at the high of yesterday’s range or a bear RVB at the low of it) can be the opening range as well.

Trend Attempt

- When a bar closes beyond the prior range/bar it is an attempt to trend (a trend attempt – TA).

- Consecutive bars of the same color with trending closes is probably a trend attempt too (think micro channel – MC).

Setups to look for

- when the Open starts as a trend, ie. “Trend from the 1st bar” (T1B), look for a “1st pullback” (1P)

- when the Open starts as a trading range, look for a failed breakout (fBO) and breakout pullback (BP), if the OR is large enough

If you’re not sure, let the trend break and take the next with-trend trade.

more on the Opening Range here:

https://www.priceactionindicators.com/2018/08/21/the-opening-range/